Introduction

A biweekly payroll calendar 2026 template serves as an indispensable tool for businesses and payroll professionals. Its primary purpose is to outline a clear, consistent schedule for wage disbursements throughout the year. This structured approach ensures timely payments, minimizes errors, and maintains financial stability for organizations. The importance of such a template extends beyond mere scheduling; it underpins employee satisfaction, facilitates regulatory compliance, and supports effective financial planning. For any entity managing a workforce, a well-defined payroll calendar is not just a convenience, but a fundamental operational necessity.

Definition and Origin of biweekly payroll calendar 2026 template

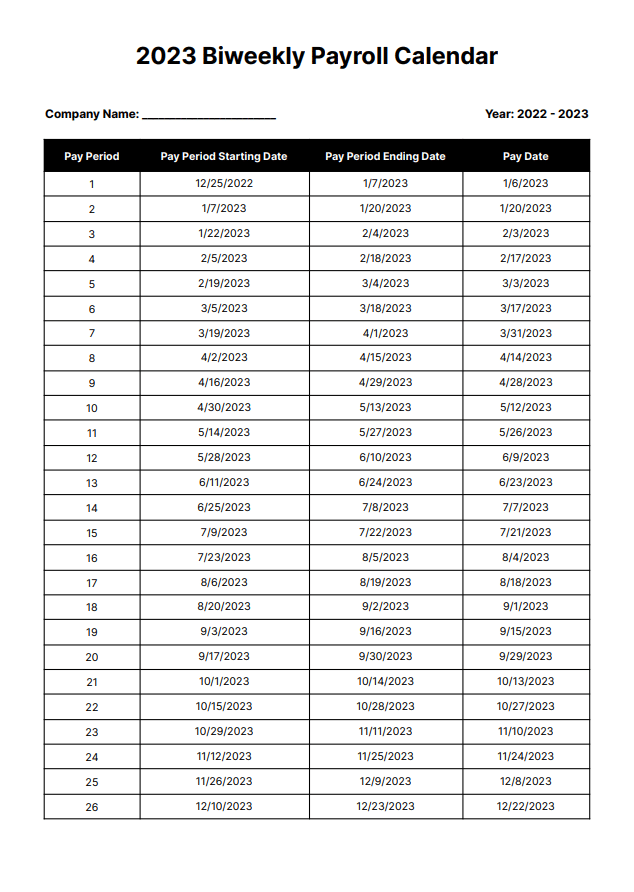

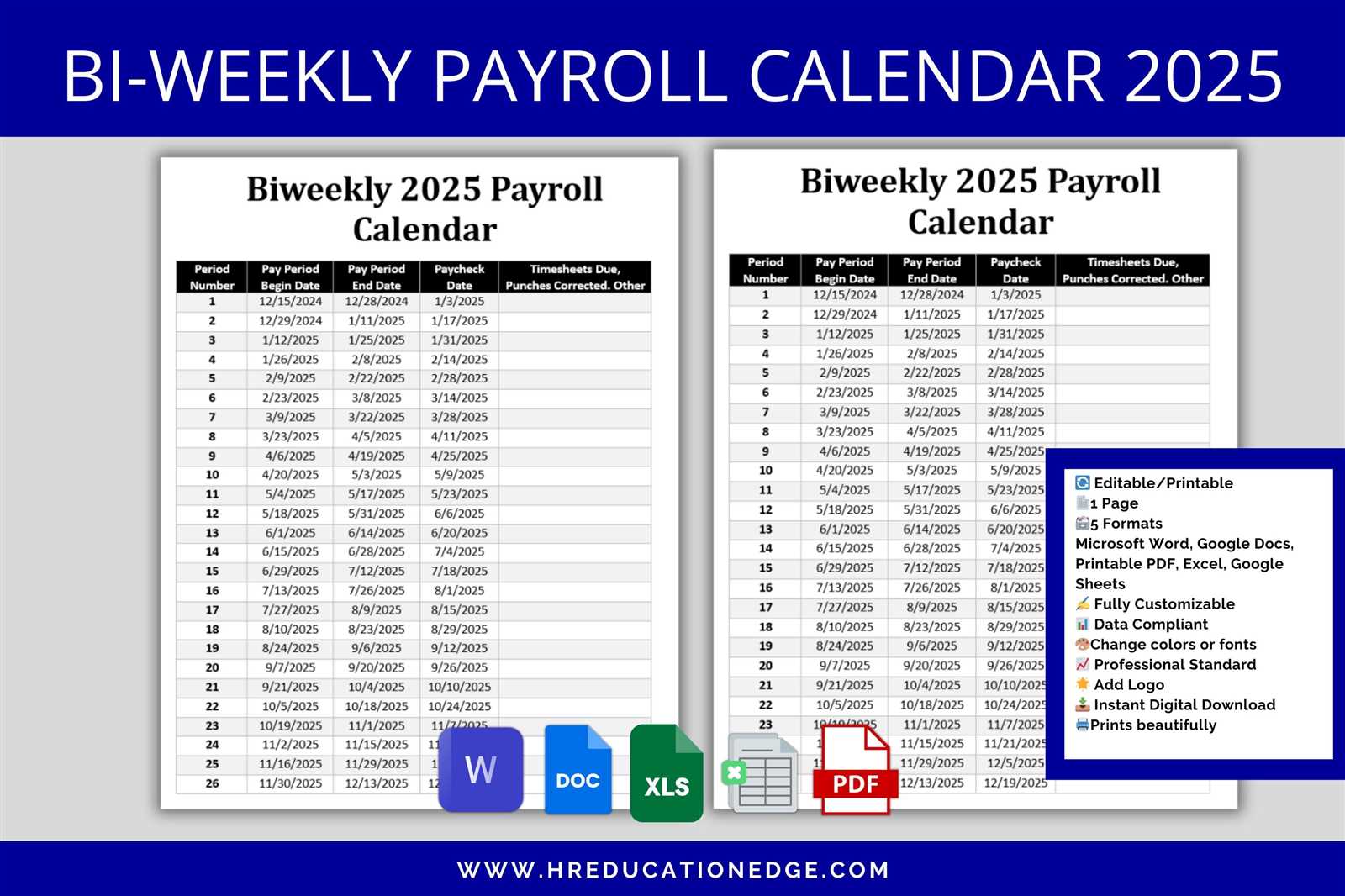

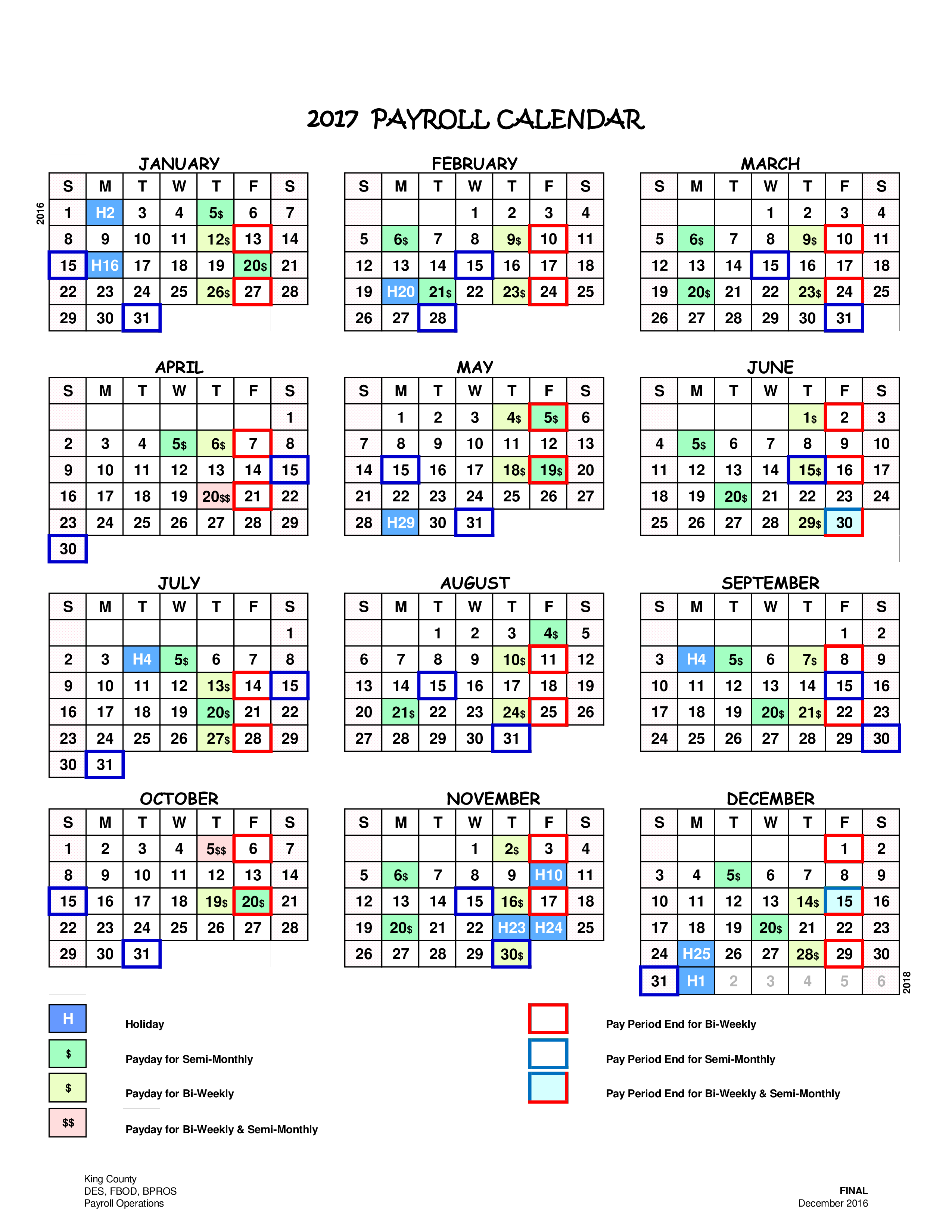

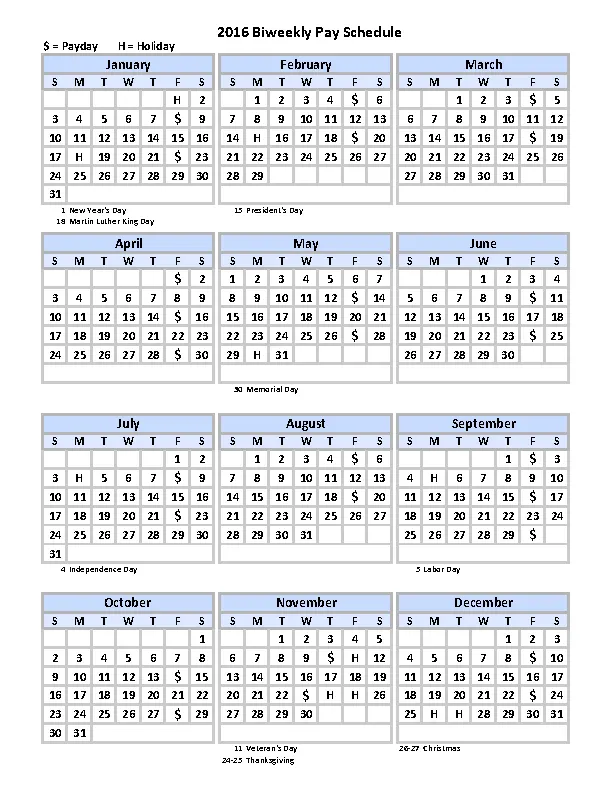

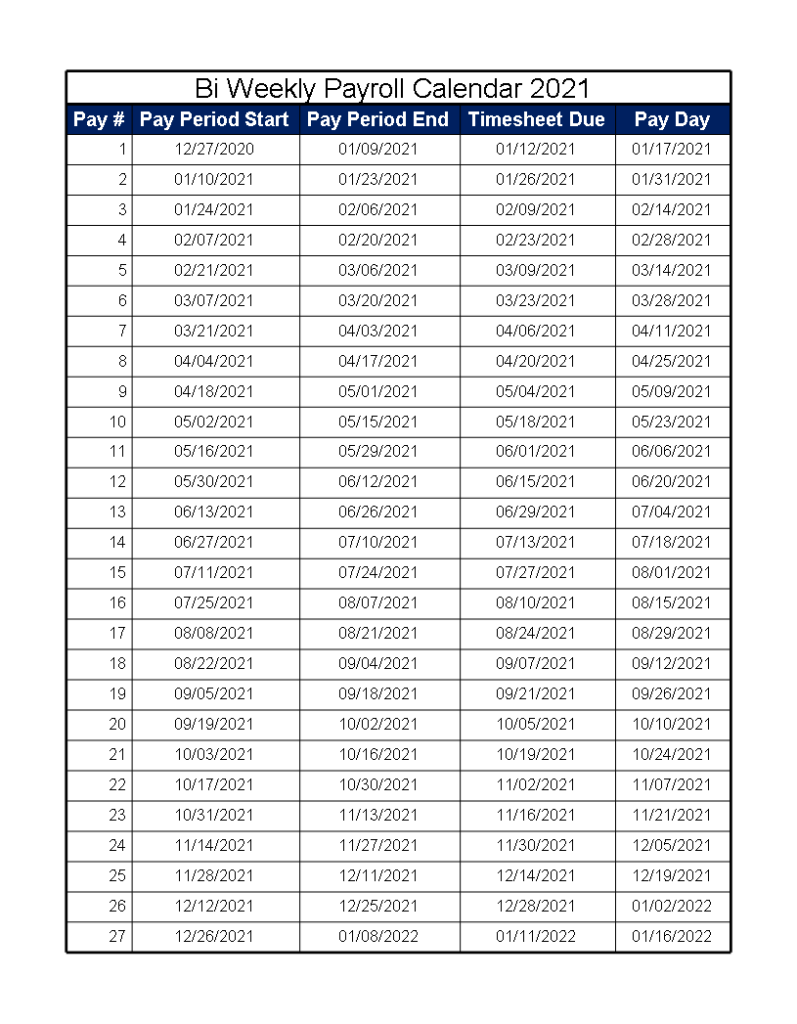

A biweekly payroll calendar 2026 template is a specific type of yearly planner designed to track and manage employee pay periods and corresponding pay dates for the year 2026. Unlike a general holiday calendar or a simple printable schedule, this template focuses exclusively on the rhythmic cycle of wage disbursement, typically occurring every two weeks. It details the start and end dates of each pay period, along with the specific day employees can expect to receive their compensation.

While modern payroll calendars are highly specialized, their underlying principles derive from broader calendar systems. The most common civil calendar, the Gregorian calendar, forms the fundamental framework for determining pay periods and dates. Other calendar types, while not directly dictating pay cycles, influence financial reporting and operational scheduling:

| Calendar Type | Primary Usage | Relevance to Payroll |

|---|---|---|

| Gregorian | Civil, daily life, global standard | Foundation for determining pay periods and specific pay dates. |

| Fiscal | Financial reporting, budgeting, tax | Defines the financial year for a business, impacting payroll budgeting and tax cycles. |

| Academic | Education sector, school year | Relevant for institutions where payroll aligns with academic terms and holidays. |

| Lunar | Religious, cultural festivals | Generally not directly used for modern business payroll scheduling. |

Historically, payroll management evolved from rudimentary ledger entries to highly structured systems. Early forms of wage payment often followed agricultural cycles or weekly market days. As economies industrialized and workforces grew, the need for standardized, predictable payment schedules became paramount. The biweekly pay cycle gained prominence for its regularity, offering employees consistent income while providing businesses with manageable administrative intervals. The creation of formalized templates, especially for specific years like the biweekly payroll calendar 2026 template, represents the ongoing refinement of these historical practices into efficient, predictable systems.

Importance of biweekly payroll calendar 2026 template Today

In today’s complex business environment, a biweekly payroll calendar 2026 template is more than just a document; it is a critical tool for planning, organization, and productivity. It ensures that businesses meet their financial obligations to employees consistently, which is vital for maintaining high morale and a stable workforce. This structured approach helps businesses allocate resources effectively, manage cash flow, and prepare for tax obligations well in advance. Without such a detailed yearly planner, payroll operations can become chaotic, leading to costly errors, employee dissatisfaction, and potential legal issues.

The practical benefits of utilizing a precise payroll schedule are extensive:

- Accurate Payment Scheduling: Guarantees employees are paid correctly and on time, reducing grievances.

- Improved Financial Forecasting: Allows businesses to predict future cash flow needs and budget for compensation expenses.

- Enhanced Employee Morale: Consistent pay fosters trust and a sense of security among the workforce.

- Reduced Risk of Penalties: Helps businesses comply with state and federal labor laws regarding pay frequency and timeliness.

- Streamlined Payroll Processing: Provides a clear roadmap for payroll departments, simplifying tasks and improving efficiency.

- Easier Tax Filing Preparation: Aligns payroll cycles with tax deadlines, making quarterly and annual tax filings smoother.

- Better Resource Allocation: Enables HR and finance teams to plan their workload around predictable payroll cycles.

The biweekly payroll calendar 2026 template thus acts as a cornerstone for efficient and compliant business operations, directly contributing to overall organizational health and employee well-being.

Benefits of biweekly payroll calendar 2026 template

The advantages of implementing a robust biweekly payroll calendar 2026 template are multifaceted, impacting various aspects of business operations and employee satisfaction.

One significant benefit lies in time management. A predefined payroll schedule eliminates guesswork for both employers and employees. Businesses can plan their payroll processing activities, including data collection, verification, and disbursement, with precision. Employees, in turn, can manage their personal finances, budget for expenses, and plan savings with the certainty of knowing their exact pay dates. This predictability reduces anxiety and promotes financial stability across the organization.

The template also greatly assists in scheduling holidays. Public holidays can disrupt standard payroll processing if not accounted for. A comprehensive biweekly payroll calendar 2026 template integrates all relevant federal and state holidays, allowing payroll departments to adjust processing deadlines and pay dates in advance. This proactive approach prevents delays in wage disbursement, ensuring employees receive their pay without interruption, even when bank holidays fall near a scheduled payday.

Furthermore, a well-structured payroll calendar supports goal tracking. For businesses, it provides a clear financial roadmap for managing compensation budgets throughout the year, aligning payroll expenses with broader financial objectives. For employees, the consistent pay cycle allows for better personal financial goal setting, such as saving for a down payment or managing debt.

Adherence to a biweekly payroll calendar also significantly enhances compliance. Many jurisdictions have specific regulations regarding pay frequency and timely payment. A detailed template helps ensure businesses meet these legal requirements, reducing the risk of fines, audits, and legal disputes. It acts as a clear record of payment intentions and actual disbursement schedules.

Finally, the template drives efficiency. By standardizing the pay cycle, businesses can automate various payroll tasks, integrate with HRIS and accounting software, and reduce the manual effort involved in processing. This not only saves time but also minimizes the potential for human error.

To illustrate the specific advantages of a biweekly schedule, it is useful to compare it with other common payroll frequencies:

| Feature | Biweekly Payroll | Semi-Monthly Payroll |

|---|---|---|

| Pay Periods per Yr | 26 | 24 |

| Consistency | Highly consistent pay dates (same day every two weeks). | Consistent, but dates vary within the month (e.g., 15th and 30th). |

| Overtime Calc. | Simpler, as pay periods align directly with weekly workweeks. | Can be more complex if pay periods split a workweek. |

| Employee Preference | Often preferred due to more frequent payments and predictability. | Common in some salaried sectors, but less frequent than biweekly. |

| Administrative Load | Slightly more frequent runs than semi-monthly, but streamlined by consistency. | Fewer runs, but potential for more complex calculations for hourly workers. |

This comparison highlights why a biweekly payroll calendar 2026 template is often favored for its clear structure and operational benefits.

Applications of biweekly payroll calendar 2026 template

The practical applications of a biweekly payroll calendar 2026 template span across various operational facets within an organization, extending from day-to-day management to long-term strategic planning. Its versatility makes it an essential tool for different departments.

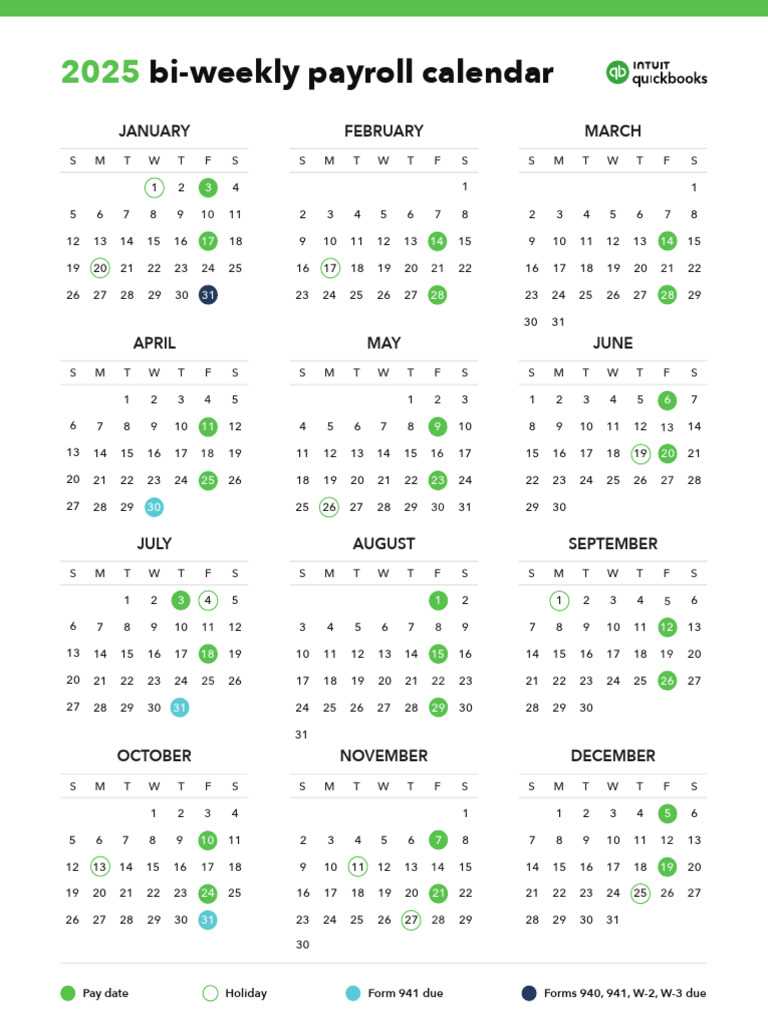

One common application is the creation of printable calendars. Many businesses prefer physical copies of the yearly planner for quick reference in HR offices, finance departments, or even for employees to post. These printable schedules clearly mark pay dates, allowing for easy visual tracking of the pay cycle.

Beyond physical copies, the template is widely used in online planners and digital payroll solutions. Integrating the biweekly payroll calendar 2026 template into HRIS (Human Resources Information Systems) or dedicated payroll software allows for automated reminders, streamlined data input, and secure record-keeping. These digital tools often feature customizable views, allowing payroll managers to see upcoming pay runs, tax deadlines, and other critical dates at a glance.

Furthermore, the template is crucial for incorporating holiday schedules. It enables businesses to proactively plan for adjustments in payroll processing due to federal, state, or company-observed holidays. This ensures that employees are paid on time, even if a standard payday falls on a non-working day.

In the realm of corporate planning, the biweekly payroll calendar 2026 template is invaluable. It serves as a foundational document for budgeting, forecasting cash flow, and planning for tax liabilities throughout the fiscal year. Financial departments rely on its predictability to manage liquidity and make informed investment decisions.

The template also plays a vital role in employee communication. By making the pay schedule transparent and easily accessible, businesses can manage employee expectations and reduce inquiries about pay dates, fostering a more trusting and efficient work environment.

Here are specific real-world uses:

- Workforce Management: Facilitates the scheduling of shifts, management of leaves (paid time off, sick leave), and projection of staffing needs based on anticipated payroll costs.

- Financial Forecasting: Provides a solid basis for predicting salary expenses, cash outflow, and overall budget adherence for the entire year.

- Tax Compliance: Aids in ensuring timely submission of payroll taxes, aligning with quarterly and annual tax filing deadlines to avoid penalties.

- Employee Communication: Serves as a clear, authoritative source for employees to understand their pay schedule, reducing ambiguities and improving transparency.

- Audit Preparedness: Maintains an organized and auditable record of pay periods and disbursement dates, crucial for internal and external financial reviews.

These applications underscore the comprehensive utility of a biweekly payroll calendar 2026 template in modern business operations.

Challenges and Future of biweekly payroll calendar 2026 template

While a biweekly payroll calendar 2026 template offers significant advantages, its implementation and ongoing management can present certain challenges. Adapting to purely digital formats remains a hurdle for some organizations, particularly those accustomed to traditional paper-based systems. The transition requires investment in software, training, and a shift in internal processes.

Another complexity arises from cultural differences in holidays and regional calendars. Businesses operating across multiple states or internationally must account for a diverse range of public holidays, which can necessitate adjustments to standard pay dates. For example, a state-specific holiday might impact banking operations, requiring an earlier payroll run. While 2026 is not a leap year, the concept of occasional extra pay periods (which occurs in years with 27 biweekly pay periods instead of the standard 26) can complicate budgeting and tax calculations, though this will not be a factor in 2026. However, integrating the payroll calendar with other internal systems, such as HR information systems (HRIS), time and attendance software, and accounting platforms, can be a technical challenge requiring robust IT infrastructure and seamless data flow.

Looking ahead, the future of the biweekly payroll calendar 2026 template is poised for significant innovation, driven by technological advancements:

- AI Calendars and Smart Scheduling: Artificial intelligence and machine learning will enable calendars to dynamically adjust pay dates based on bank holidays, employee leave, and even predictive analytics for cash flow, offering automated adjustments and optimized scheduling.

- Mobile Apps and Cloud Solutions: Increased reliance on mobile applications will provide payroll managers and employees with on-the-go access to schedules, pay stubs, and important notifications, enhancing flexibility and convenience. Cloud-based solutions will ensure data accessibility and security from anywhere.

- Enhanced Integration: Future templates will offer deeper, more seamless integration with a wider ecosystem of business software, including performance management systems, benefits administration platforms, and advanced analytics tools, creating a unified operational view.

- Blockchain for Payroll: Emerging technologies like blockchain could introduce greater security, transparency, and immutability to payroll records, potentially streamlining international payments and reducing fraud.

- Predictive Analytics: Beyond just scheduling, future payroll calendars will leverage data to predict future payroll costs, identify potential compliance risks, and offer strategic insights for workforce planning.

These future trends suggest a move towards more intelligent, integrated, and user-centric payroll calendar solutions, further enhancing their value as a core business tool.

FAQs about biweekly payroll calendar 2026 template

Q1: What is a biweekly payroll calendar 2026 template?

A biweekly payroll calendar 2026 template is a detailed schedule that outlines all pay periods and corresponding pay dates for employees paid on a biweekly basis throughout the year 2026. It serves as a clear, organized guide for managing wage disbursements.

Q2: Why is biweekly payroll calendar 2026 template important?

It is crucial for ensuring accuracy, maintaining compliance with labor laws, guaranteeing timely payments to employees, and facilitating robust financial planning for businesses. This structured approach contributes to operational efficiency and employee satisfaction.

Q3: What are the main benefits of using a biweekly payroll calendar 2026 template?

Key benefits include improved time management for payroll processing, effective planning for holidays, assistance in tracking financial goals, enhanced regulatory compliance, and increased overall operational efficiency in wage disbursement.

Q4: How can biweekly payroll calendar 2026 template be applied in daily life?

For employees, it provides a predictable income schedule, allowing for personal budgeting, managing bills, and planning financial activities. For businesses, it underpins workforce management, financial forecasting, and tax compliance, making daily operations smoother.

Q5: What challenges are associated with biweekly payroll calendar 2026 template?

Challenges include the adaptation to digital payroll systems, managing variations in regional and cultural holidays, ensuring seamless integration with other business software, and occasionally handling years with an extra pay period (though not applicable for 2026).

Tips for biweekly payroll calendar 2026 template

Implementing and utilizing a biweekly payroll calendar 2026 template effectively requires strategic planning and consistent attention. Adhering to best practices can significantly enhance its utility and streamline payroll operations.

Choose the right calendar type for your needs.

Select a template that aligns perfectly with your business’s specific pay cycle, regulatory environment, and internal processes. Consider whether a generic template needs customization to include company-specific holidays or unique payroll rules. The chosen template should integrate seamlessly with your existing HR and accounting systems.

Keep calendars updated regularly.

Ensure that the biweekly payroll calendar 2026 template reflects any changes in federal or state holidays, banking schedules, or company-specific policies that might affect pay dates. Proactive updates prevent errors and ensure continuous compliance. Regularly verify the accuracy of pay period start and end dates.

Integrate digital tools for reminders.

Leverage payroll software, HRIS, or even simple calendar applications to set automated reminders for critical payroll deadlines. These include pay run processing dates, tax deposit due dates, and year-end reporting requirements. Digital integration reduces the chance of missed deadlines and improves efficiency.

Plan holidays and deadlines in advance.

Review the entire biweekly payroll calendar 2026 template at the beginning of the year to identify any public holidays that might impact standard pay dates. Proactively adjust payroll processing schedules to ensure employees receive their compensation on time, even if a holiday falls on a scheduled payday. Communicate these adjustments clearly to employees.

Use calendars to track personal and professional goals.

Beyond basic payroll, utilize the predictability of the biweekly payroll calendar 2026 template for broader financial planning. Businesses can align cash flow management and budgeting with the pay cycles. Employees can use their consistent pay dates to manage personal finances, set savings goals, and plan for major expenditures, fostering financial well-being.

Conclusion about biweekly payroll calendar 2026 template

The biweekly payroll calendar 2026 template stands as an indispensable tool for modern businesses. Its role in ensuring accurate, timely, and compliant wage disbursements cannot be overstated. From simplifying time management and holiday scheduling to enhancing financial forecasting and regulatory adherence, this yearly planner forms the backbone of efficient payroll operations. It fosters employee satisfaction through predictable pay cycles and empowers businesses with the structure needed for sound financial management. As organizations continue to navigate evolving digital landscapes and regulatory complexities, a well-implemented biweekly payroll calendar 2026 template remains a critical asset. Its practical and cultural significance underscores its lasting importance, reinforcing its position as a cornerstone for both daily operational success and long-term strategic planning. Embracing such a template is not just about processing payments; it is about building a stable, compliant, and productive work environment for the future.