Navigating Retirement Savings in 2025: Understanding IRA Contribution Limits for Individuals Over 65

Navigating Retirement Savings in 2025: Understanding IRA Contribution Limits for Individuals Over 65

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating Retirement Savings in 2025: Understanding IRA Contribution Limits for Individuals Over 65. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Retirement Savings in 2025: Understanding IRA Contribution Limits for Individuals Over 65

As individuals approach and surpass the age of 65, retirement planning becomes increasingly crucial. One vital aspect of this planning involves understanding the contribution limits for Individual Retirement Accounts (IRAs). These limits, subject to annual adjustments by the Internal Revenue Service (IRS), play a significant role in maximizing retirement savings and potentially reducing tax burdens.

Understanding IRA Contribution Limits

IRAs offer tax advantages for retirement savings. Contributions to traditional IRAs may be tax-deductible, leading to immediate tax savings. Conversely, contributions to Roth IRAs are made with after-tax dollars, but qualified withdrawals in retirement are tax-free. Regardless of the IRA type, annual contribution limits exist to ensure fairness and promote responsible saving.

2025 IRA Contribution Limits for Individuals Over 65

While the exact contribution limits for 2025 are yet to be announced by the IRS, it is possible to project them based on historical trends and current economic conditions. The IRS typically announces these limits in late October or early November of the preceding year.

Projected 2025 IRA Contribution Limits:

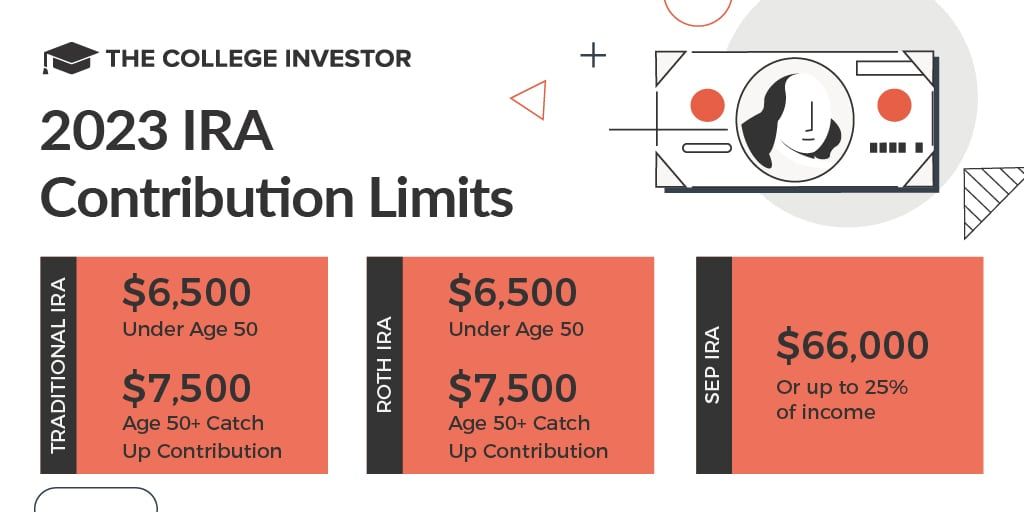

- Traditional and Roth IRA: It is likely that the 2025 contribution limit for both Traditional and Roth IRAs will remain at $7,500 for individuals under the age of 50.

- Catch-up Contribution: For individuals aged 50 and over, a catch-up contribution is allowed, adding an additional amount to the regular limit. The projected catch-up contribution for 2025 is $1,000, bringing the total allowable contribution to $8,500.

Important Considerations for Individuals Over 65:

- Age is Not a Barrier: There is no age limit for contributing to an IRA. Even after reaching age 70 1/2, individuals can continue making contributions, although certain rules apply regarding required minimum distributions (RMDs).

- RMDs and IRA Contributions: Individuals aged 70 1/2 and older are generally required to take RMDs from their traditional IRAs, Roth IRAs, and other retirement accounts. However, there is no age limit for making contributions to Roth IRAs, and individuals can continue to contribute to a Roth IRA even after beginning RMDs from other retirement accounts.

- Traditional IRA Deductibility: The deductibility of contributions to a Traditional IRA is based on income and filing status. For 2023, individuals with modified adjusted gross incomes (MAGI) above $73,000 (single filers) or $146,000 (married filing jointly) are ineligible for the full deduction. These limits are subject to annual adjustments by the IRS.

FAQs Regarding 2025 IRA Contribution Limits Over 65:

1. Can I contribute to both a Traditional and Roth IRA in the same year?

Yes, individuals can contribute to both a Traditional and a Roth IRA in the same year, but the total contribution amount cannot exceed the annual limit.

2. Can I contribute to an IRA if I am already receiving Social Security benefits?

Yes, receiving Social Security benefits does not affect your eligibility to contribute to an IRA.

3. Can I contribute to an IRA if I am still working?

Yes, individuals who are still working can contribute to an IRA, regardless of whether they are covered by a workplace retirement plan.

4. If I am over 70 1/2, can I still make IRA contributions?

Yes, there is no age limit for making contributions to a Roth IRA. For Traditional IRAs, contributions are allowed even after age 70 1/2, but certain rules apply regarding RMDs.

5. When will the IRS announce the official contribution limits for 2025?

The IRS typically announces the contribution limits for the following year in late October or early November of the preceding year.

Tips for Maximizing IRA Contributions in 2025:

- Start Early: The earlier you begin contributing to an IRA, the more time your savings have to grow.

- Maximize Contributions: Take advantage of the full contribution limit each year to maximize your savings potential.

- Consider Catch-up Contributions: If you are 50 or older, utilize the catch-up contribution to boost your savings.

- Choose the Right IRA Type: Determine whether a Traditional or Roth IRA best suits your financial situation and tax goals.

- Consult a Financial Advisor: A qualified financial advisor can provide personalized advice and help you develop a comprehensive retirement savings plan.

Conclusion:

Understanding and utilizing the IRA contribution limits for individuals over 65 is crucial for building a secure and comfortable retirement. By maximizing contributions and taking advantage of the tax benefits offered by IRAs, individuals can significantly enhance their long-term financial well-being. Staying informed about annual adjustments to contribution limits and seeking professional advice can help individuals navigate the complex world of retirement savings effectively.

Closure

Thus, we hope this article has provided valuable insights into Navigating Retirement Savings in 2025: Understanding IRA Contribution Limits for Individuals Over 65. We appreciate your attention to our article. See you in our next article!