Navigating the 2025 Simple IRA Contribution Landscape: A Guide for Individuals and Small Businesses

Navigating the 2025 Simple IRA Contribution Landscape: A Guide for Individuals and Small Businesses

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the 2025 Simple IRA Contribution Landscape: A Guide for Individuals and Small Businesses. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the 2025 Simple IRA Contribution Landscape: A Guide for Individuals and Small Businesses

The Simple IRA (Savings Incentive Match Plan for Employees) offers a valuable retirement savings vehicle for individuals and small businesses. Understanding the contribution limits is crucial for maximizing its benefits and ensuring a secure financial future. This article provides a comprehensive overview of the 2025 Simple IRA contribution limits, outlining their significance and practical implications.

Understanding Simple IRA Contribution Limits:

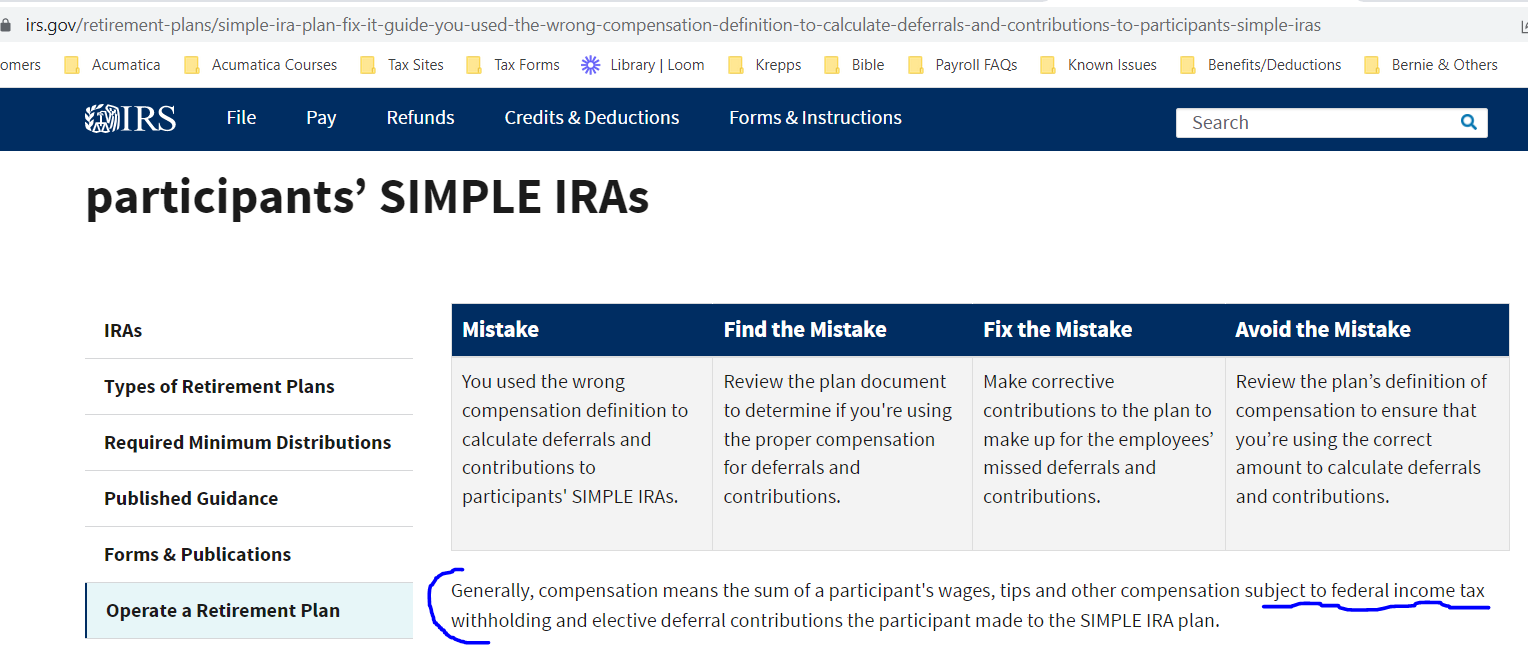

The Simple IRA contribution limits are designed to encourage retirement savings while providing flexibility for both employers and employees. These limits, set by the Internal Revenue Service (IRS), dictate the maximum amount that can be contributed to a Simple IRA each year.

2025 Contribution Limits:

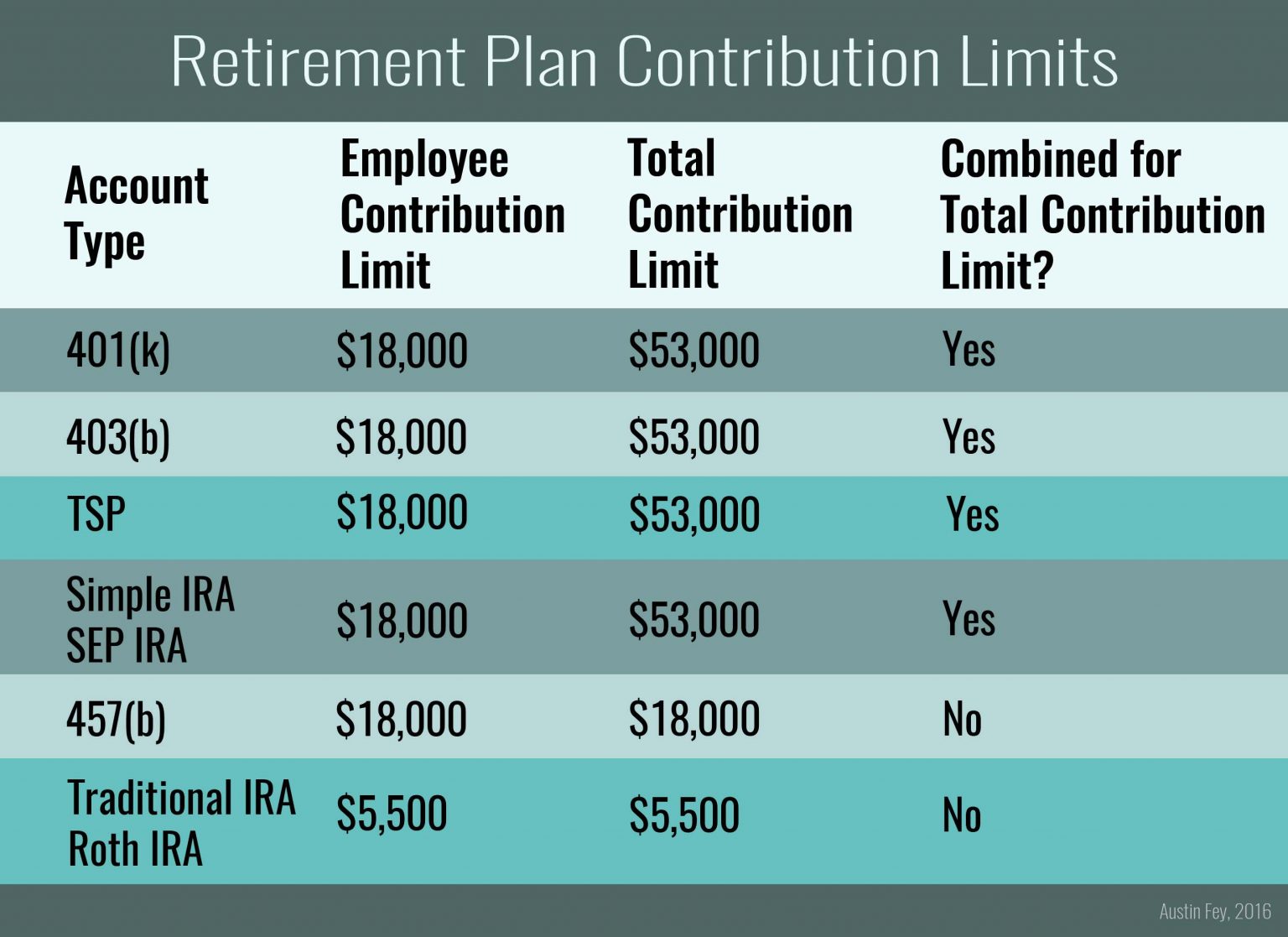

- Employee Contributions: In 2025, employees can contribute up to $15,500 to their Simple IRA.

- Employer Contributions: Employers can contribute up to 2% of an employee’s compensation, or a matching contribution of up to 3% of the employee’s compensation, whichever is greater.

- Combined Contributions: The combined total of employee and employer contributions cannot exceed $15,500 in 2025.

Significance of Contribution Limits:

The contribution limits serve as a guide for individuals and employers to plan their retirement savings strategy. They help ensure that contributions remain within the parameters set by the IRS, allowing for tax-advantaged growth and potential tax deductions.

Benefits of Simple IRA Contributions:

- Tax Advantages: Contributions to a Simple IRA are made with pre-tax dollars, reducing taxable income and potentially leading to tax savings.

- Growth Potential: Funds within a Simple IRA grow tax-deferred, allowing for potentially higher returns over time.

- Employer Match: The employer matching contribution feature can significantly boost retirement savings.

- Accessibility: Simple IRAs are relatively straightforward to set up and administer, making them accessible to individuals and small businesses.

Factors Affecting Contribution Limits:

- Age: Individuals aged 50 and older can make catch-up contributions, allowing them to contribute an additional amount beyond the regular contribution limit.

- Income: While there are no income limits for participation in a Simple IRA, the contribution limit may be adjusted based on income for other retirement plans.

Frequently Asked Questions (FAQs) Regarding 2025 Simple IRA Contribution Limits:

1. Can I contribute more than the limit in 2025?

No, exceeding the contribution limit can result in penalties and taxes. It’s crucial to adhere to the established limits.

2. What happens if I contribute less than the limit?

You are not obligated to contribute the full amount allowed. However, maximizing contributions can accelerate retirement savings growth.

3. Can I withdraw my contributions before retirement?

Early withdrawals are generally subject to penalties and taxes, unless specific exceptions apply.

4. How do I know if I’m eligible for a Simple IRA?

Eligibility criteria for Simple IRAs vary depending on your employer’s plan. Consult with your employer or a financial advisor.

5. What are the tax implications of contributions?

Contributions to a Simple IRA are tax-deductible, potentially reducing your taxable income. However, withdrawals in retirement are subject to taxation.

Tips for Maximizing 2025 Simple IRA Contributions:

- Contribute the Maximum: Aim to contribute the full allowable amount, as this maximizes tax advantages and long-term growth potential.

- Take Advantage of Employer Matching: If your employer offers matching contributions, ensure you contribute enough to receive the full match.

- Review Your Contributions Regularly: Periodically review your contribution levels to ensure they align with your retirement goals and financial situation.

- Seek Professional Advice: Consult with a financial advisor to develop a personalized retirement savings plan that incorporates Simple IRA contributions.

Conclusion:

The 2025 Simple IRA contribution limits provide a framework for individuals and small businesses to build a strong foundation for retirement savings. By understanding these limits and maximizing contributions, individuals can take advantage of tax benefits and potential growth, securing a more comfortable financial future. It is essential to stay informed about the latest regulations and seek professional guidance to navigate the complexities of retirement planning effectively.

Closure

Thus, we hope this article has provided valuable insights into Navigating the 2025 Simple IRA Contribution Landscape: A Guide for Individuals and Small Businesses. We appreciate your attention to our article. See you in our next article!