Navigating the Roth IRA Contribution Landscape: A Guide for Married Couples in 2025

Navigating the Roth IRA Contribution Landscape: A Guide for Married Couples in 2025

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Roth IRA Contribution Landscape: A Guide for Married Couples in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Roth IRA Contribution Landscape: A Guide for Married Couples in 2025

The Roth IRA, a popular retirement savings vehicle, allows individuals to contribute after-tax dollars, potentially growing tax-free in retirement. For married couples, understanding the contribution limits and nuances is crucial to maximizing their retirement savings potential. While the exact 2025 contribution limits are not yet finalized, current trends and projections offer valuable insights for couples planning their financial futures.

Understanding the Basics

The Roth IRA contribution limit is the maximum amount an individual can contribute each year. This limit applies regardless of marital status, meaning both spouses can contribute independently. However, the contribution limit is adjusted for those with high incomes, known as the Modified Adjusted Gross Income (MAGI).

Projected Contribution Limits for 2025

While the official 2025 limits are yet to be announced, based on recent trends and historical adjustments, it is reasonable to anticipate the following:

- General Contribution Limit: The general contribution limit for 2025 could be around $7,000 per individual. This represents an increase from the 2023 limit of $6,500.

- Catch-Up Contribution Limit: Individuals aged 50 and older may be able to contribute an additional $1,000 in 2025, bringing their total contribution limit to $8,000.

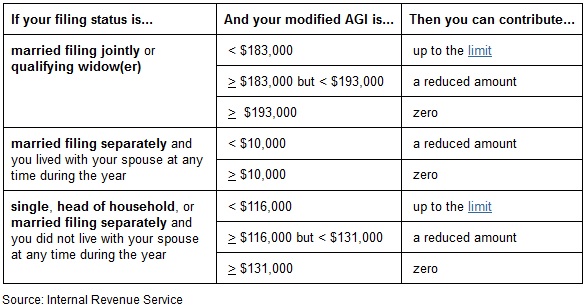

Navigating the Income Limits

While the general contribution limit applies to most, individuals with higher incomes may face limitations. In 2023, the income limits for contributing to a Roth IRA are:

- Single Filers: $153,000 MAGI or higher

- Married Filing Jointly: $228,000 MAGI or higher

- Head of Household: $208,000 MAGI or higher

These limits are subject to change annually, and it is essential to consult official IRS guidance for the latest information.

Strategic Planning for Married Couples

With a clear understanding of the contribution limits and income thresholds, married couples can employ several strategies to maximize their Roth IRA contributions:

- Individual Contributions: Both spouses can contribute to their own Roth IRAs, potentially reaching a combined contribution of $14,000 in 2025, assuming they meet the income limits.

- Spousal IRA Contributions: If one spouse has a significantly higher income, the other spouse may be able to contribute to a Roth IRA even if their income is above the threshold. This strategy can be beneficial if the higher-earning spouse is approaching the income limit for contributing to a Roth IRA.

- Early Contributions: Starting contributions early, even if the amount is modest, can significantly benefit from compound growth over time.

- Reviewing Income Limits: As income levels change, it is essential to re-evaluate the eligibility for Roth IRA contributions.

Frequently Asked Questions

Q: Can I contribute to a Roth IRA if I am already enrolled in a 401(k) plan?

A: Yes, you can contribute to both a Roth IRA and a 401(k) plan, provided you meet the contribution limits and income thresholds for both.

Q: Can I withdraw my contributions from a Roth IRA before retirement?

A: You can withdraw contributions from a Roth IRA at any time without penalty, as long as the withdrawal is for a qualified reason such as a first-time home purchase, education expenses, or medical expenses.

Q: What happens to my Roth IRA when I pass away?

A: Your Roth IRA will be passed on to your beneficiaries, who can then withdraw the funds tax-free.

Tips for Maximizing Roth IRA Contributions

- Automate Contributions: Set up automatic contributions from your checking account to your Roth IRA to ensure consistent saving.

- Review and Adjust: Periodically review your income levels and contribution limits to ensure you are maximizing your savings potential.

- Seek Professional Advice: Consult with a financial advisor to create a personalized retirement savings plan that aligns with your individual goals and circumstances.

Conclusion

Understanding the Roth IRA contribution limits and income thresholds is crucial for married couples seeking to optimize their retirement savings. By strategically planning and contributing consistently, couples can harness the benefits of tax-free growth, ensuring a comfortable and financially secure retirement. Remember, the information provided here is for general knowledge and should not be considered financial advice. Consulting a qualified financial professional is essential for making informed decisions about your retirement savings.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Roth IRA Contribution Landscape: A Guide for Married Couples in 2025. We hope you find this article informative and beneficial. See you in our next article!