Navigating the 2025 Medicare Premium Landscape: Understanding Modified Adjusted Gross Income (MAGI) Limits

Navigating the 2025 Medicare Premium Landscape: Understanding Modified Adjusted Gross Income (MAGI) Limits

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the 2025 Medicare Premium Landscape: Understanding Modified Adjusted Gross Income (MAGI) Limits. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the 2025 Medicare Premium Landscape: Understanding Modified Adjusted Gross Income (MAGI) Limits

Medicare, the federal health insurance program for individuals aged 65 and older and those with certain disabilities, offers a crucial safety net for healthcare expenses. However, the cost of Medicare premiums can vary significantly based on an individual’s income. This variation is determined by Modified Adjusted Gross Income (MAGI), a measure used to calculate premium costs.

Understanding MAGI: A Key to Determining Medicare Premiums

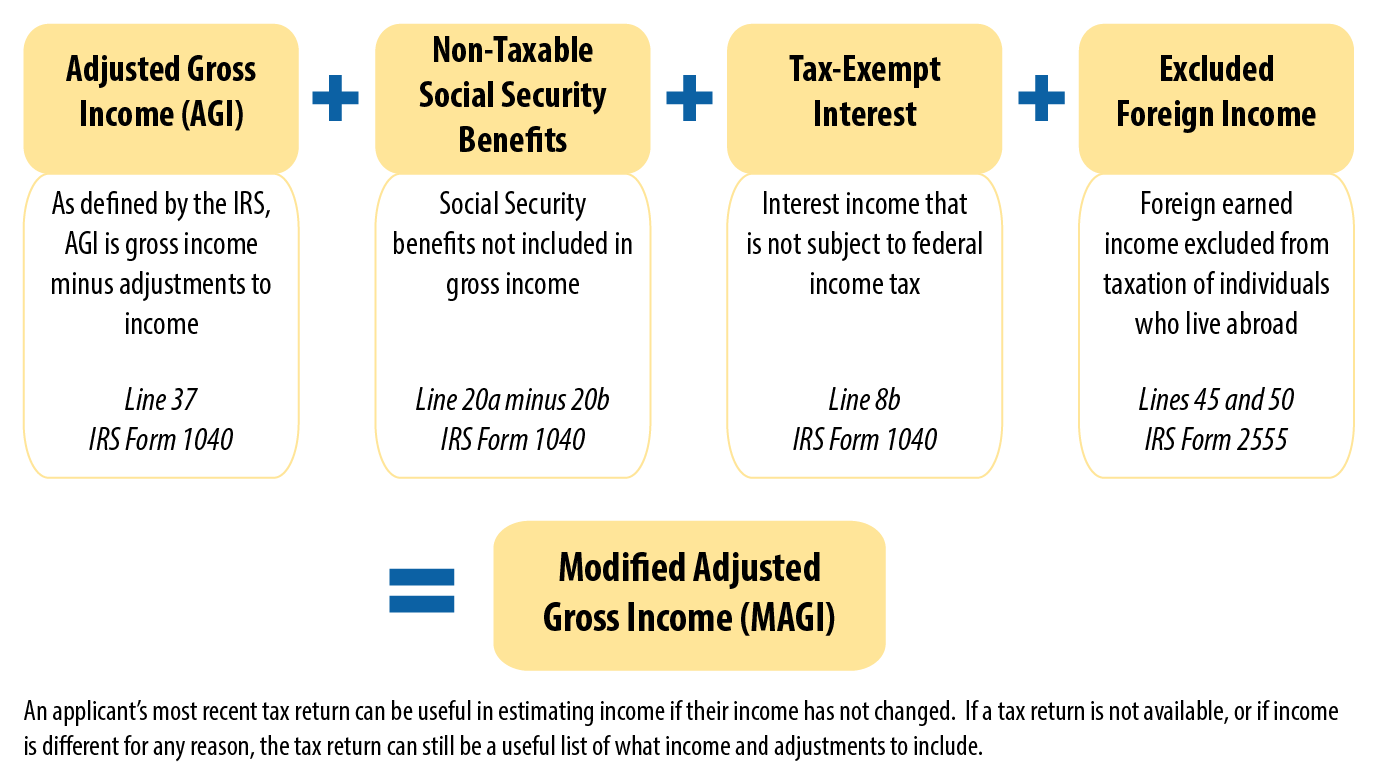

MAGI is a modified version of adjusted gross income (AGI) as reported on an individual’s tax return. It includes AGI along with certain adjustments that are not factored into AGI calculations. These adjustments can include income from tax-exempt interest, certain deductions, and other factors.

For Medicare purposes, MAGI serves as a crucial indicator of an individual’s financial capacity. Higher MAGI generally translates to higher Medicare premiums, while lower MAGI can result in lower premiums. The exact MAGI limits and corresponding premium amounts are updated annually by the Centers for Medicare & Medicaid Services (CMS).

2025 MAGI Limits and Their Impact on Medicare Premiums

The 2025 MAGI limits for Medicare premiums are yet to be officially announced by CMS. However, based on historical trends and current economic conditions, it is likely that these limits will be adjusted to reflect inflation and other economic factors.

Once the 2025 MAGI limits are released, individuals can use this information to determine their potential Medicare premium costs. By comparing their MAGI to the relevant thresholds, they can gain a clear understanding of their premium obligations.

The Importance of Understanding 2025 MAGI Limits

Comprehending the 2025 MAGI limits for Medicare premiums is crucial for several reasons:

- Budgeting and Financial Planning: Knowing the potential premium costs allows individuals to accurately budget for their healthcare expenses and make informed financial decisions.

- Avoiding Unexpected Costs: Understanding the MAGI limits helps individuals avoid surprises related to their Medicare premiums, ensuring they are prepared for the financial obligations associated with their healthcare coverage.

- Potential for Savings: Individuals with lower MAGI may be eligible for lower premiums, potentially saving them significant amounts of money over time.

- Eligibility for Extra Help: Individuals with limited income and resources may be eligible for the Medicare Savings Programs, which can help offset the cost of premiums, deductibles, and coinsurance.

Navigating the 2025 MAGI Landscape: FAQs

1. When will the 2025 MAGI limits be announced?

The 2025 MAGI limits for Medicare premiums are typically announced by CMS in the fall of the preceding year. This information is usually released alongside the annual Medicare premium and deductible updates.

2. How do I calculate my MAGI?

Calculating your MAGI can be complex and requires careful consideration of various income sources and adjustments. It is recommended to consult a tax professional or use the IRS’s online resources to determine your accurate MAGI.

3. What happens if my MAGI exceeds the limit?

If your MAGI exceeds the applicable limit, you will be subject to higher Medicare premiums. The exact premium increase will depend on your MAGI level and the specific premium structure for the year.

4. Can I do anything to lower my MAGI?

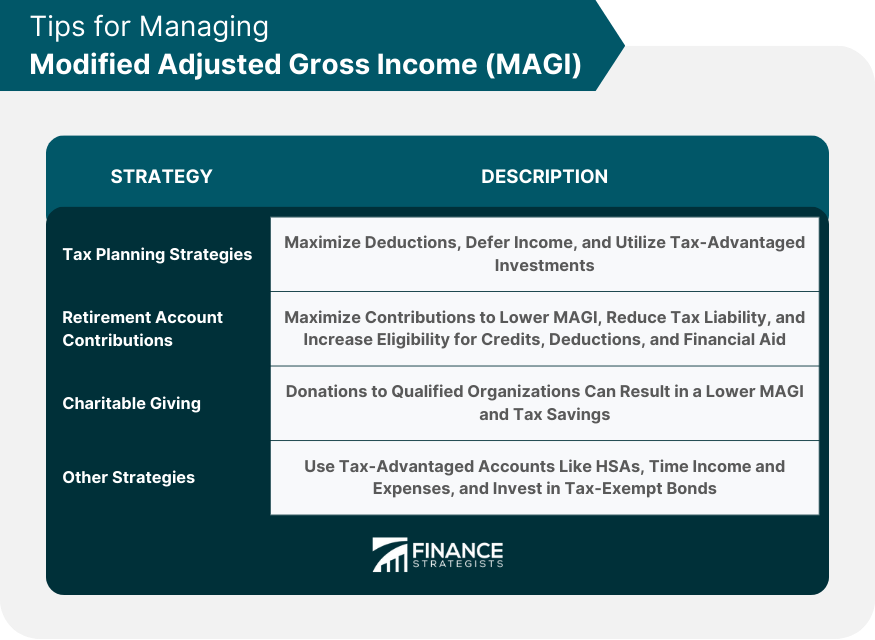

While there are no guaranteed methods to significantly lower your MAGI, certain strategies can help, such as:

- Contributing to a Roth IRA: Contributions to a Roth IRA are not included in MAGI calculations, potentially lowering your overall MAGI.

- Making Charitable Donations: Charitable donations can reduce your taxable income, potentially lowering your MAGI.

- Taking Advantage of Tax Credits: Certain tax credits, such as the Earned Income Tax Credit, can reduce your taxable income and potentially lower your MAGI.

5. Where can I find more information about the 2025 MAGI limits?

The most reliable source of information about the 2025 MAGI limits is the official CMS website. You can also consult with a Medicare specialist or a qualified tax professional for further guidance.

Tips for Managing Your Medicare Premiums in 2025

- Stay Informed: Regularly check the CMS website and other reliable sources for updates on Medicare premiums and MAGI limits.

- Plan Ahead: Factor potential premium costs into your financial planning to ensure you can comfortably afford your Medicare coverage.

- Explore Savings Options: Consider taking advantage of available savings programs, such as the Medicare Savings Programs, if you qualify.

- Seek Professional Guidance: Consult with a Medicare specialist or a qualified tax professional for personalized advice on managing your Medicare premiums and navigating the complex MAGI landscape.

Conclusion: Navigating the Changing Medicare Landscape

The 2025 MAGI limits for Medicare premiums will play a significant role in determining the cost of healthcare for millions of Americans. Understanding these limits and their potential impact is crucial for individuals to effectively manage their healthcare expenses and ensure they have access to the necessary coverage. By staying informed, planning ahead, and seeking professional guidance, individuals can navigate the ever-changing Medicare landscape and secure the healthcare they need.

:max_bytes(150000):strip_icc()/Magi-ea7d64c7ba3f426cb9a7f0bb1382aa15.jpg)

Closure

Thus, we hope this article has provided valuable insights into Navigating the 2025 Medicare Premium Landscape: Understanding Modified Adjusted Gross Income (MAGI) Limits. We hope you find this article informative and beneficial. See you in our next article!