Navigating Retirement Savings: Understanding the IRA Contribution Limit for Individuals Over 50

Navigating Retirement Savings: Understanding the IRA Contribution Limit for Individuals Over 50

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating Retirement Savings: Understanding the IRA Contribution Limit for Individuals Over 50. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Retirement Savings: Understanding the IRA Contribution Limit for Individuals Over 50

Retirement planning is an essential aspect of financial well-being, particularly for individuals approaching their later years. The Internal Revenue Service (IRS) provides various tax-advantaged retirement savings options, including Individual Retirement Accounts (IRAs). For those over 50, the IRS allows an additional contribution known as the "catch-up contribution," offering a valuable opportunity to accelerate retirement savings.

This article delves into the intricacies of the IRA contribution limit for individuals over 50, exploring its significance, benefits, and potential implications for retirement planning.

Understanding the IRA Contribution Limit

The IRA contribution limit represents the maximum amount an individual can contribute to their IRA each year. This limit varies based on age and is subject to adjustments based on inflation.

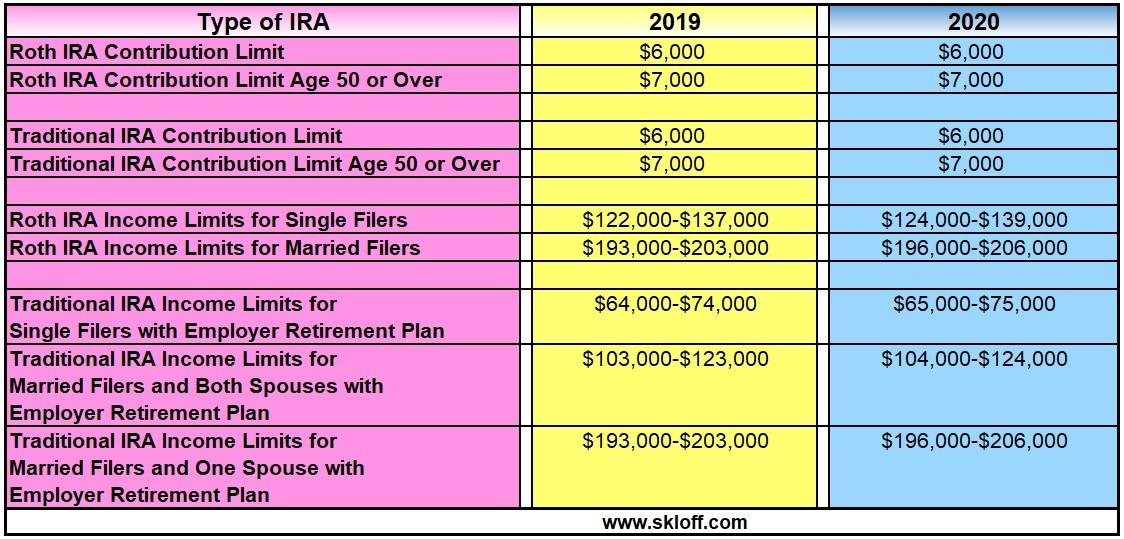

For 2023, the standard IRA contribution limit is $6,500. However, individuals aged 50 and over can contribute an additional $1,000, bringing their total contribution limit to $7,500. This "catch-up contribution" aims to help older individuals make up for lost time in saving for retirement.

The Importance of the Catch-Up Contribution

The catch-up contribution holds significant importance for individuals over 50 for several reasons:

- Accelerated Savings: The additional contribution allows for a substantial increase in retirement savings, potentially leading to a more comfortable retirement.

- Tax Advantages: Contributions to traditional IRAs are tax-deductible, potentially reducing current tax liability. This benefit can be particularly valuable for individuals in higher tax brackets.

- Retirement Security: The catch-up contribution can help bridge the gap between current savings and retirement goals, potentially mitigating the risk of outliving savings.

- Flexibility: Individuals can choose to contribute the full catch-up amount or a portion of it, depending on their financial circumstances and savings goals.

Factors Affecting the IRA Contribution Limit

Several factors can influence the IRA contribution limit, including:

- Age: The catch-up contribution is available only to individuals aged 50 and over.

- Income: The IRS may limit or restrict contributions based on income levels, particularly for traditional IRAs.

- Contribution Type: The contribution limit applies to both traditional and Roth IRAs.

- Year: The contribution limit is subject to annual adjustments based on inflation.

Navigating the IRA Contribution Limit: Key Considerations

While the catch-up contribution offers a valuable opportunity to boost retirement savings, it’s essential to consider several factors before making contributions:

- Financial Circumstances: Evaluate your current financial situation and determine if you can afford the additional contribution without jeopardizing other financial goals.

- Retirement Goals: Consider your desired retirement lifestyle and estimate the amount of savings needed to achieve it.

- Tax Implications: Understand the tax implications of traditional and Roth IRAs, as they differ in how contributions and withdrawals are treated.

- Investment Strategy: Choose investments that align with your risk tolerance and retirement time horizon.

FAQs about the IRA Contribution Limit for Individuals Over 50

Q: Can I contribute to both a traditional IRA and a Roth IRA in the same year?

A: Yes, you can contribute to both a traditional and a Roth IRA in the same year, but the total contribution cannot exceed the annual limit.

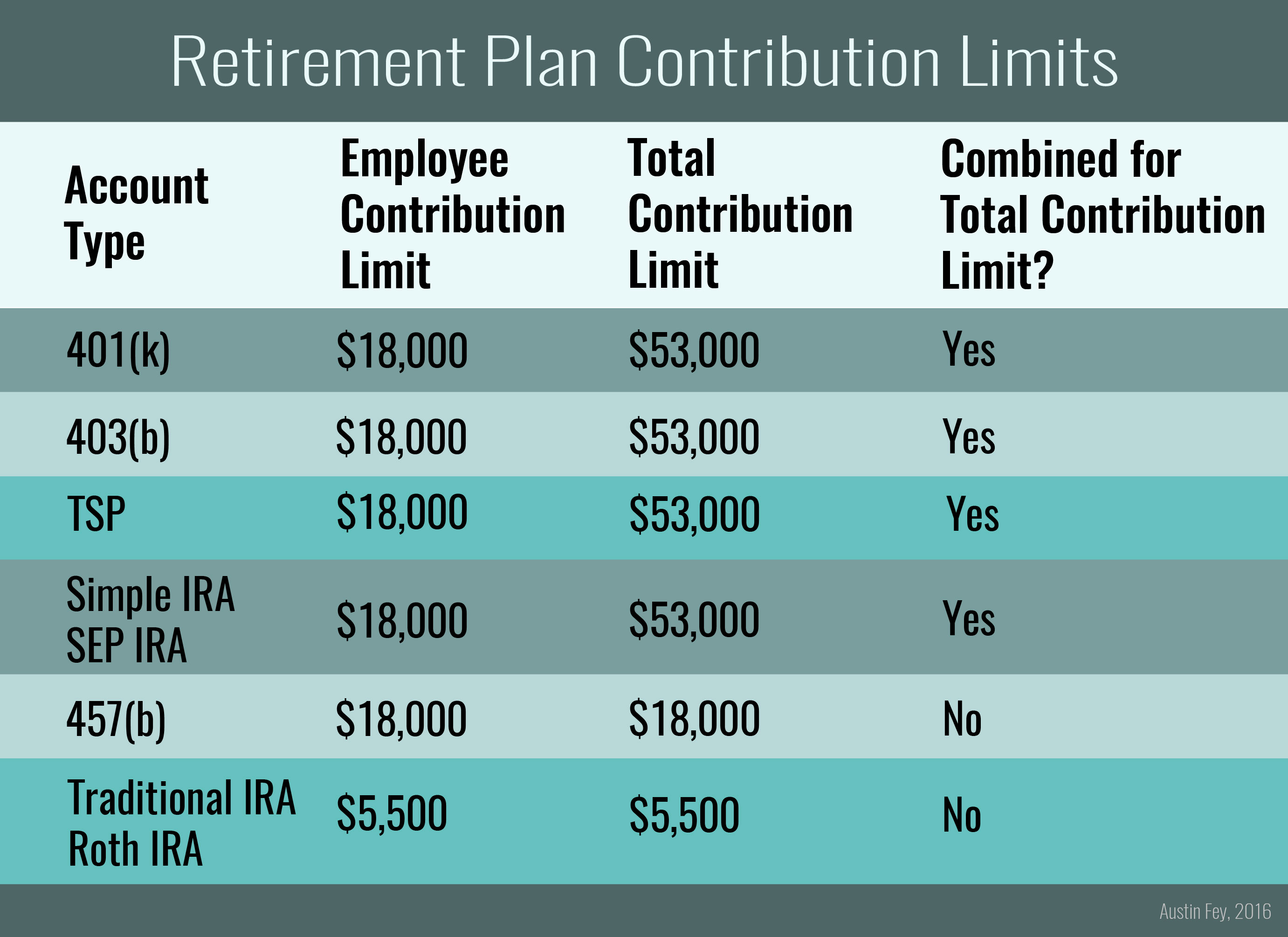

Q: Can I contribute to an IRA if I am already participating in a 401(k) plan?

A: Yes, you can contribute to both an IRA and a 401(k) plan, subject to the annual contribution limits for each.

Q: What happens if I contribute more than the IRA contribution limit?

A: If you contribute more than the annual limit, you may be subject to penalties and taxes.

Q: Can I withdraw contributions from my IRA before retirement?

A: You can withdraw contributions from a traditional IRA before retirement without penalty, but withdrawals from a Roth IRA are generally tax-free and penalty-free only after age 59 1/2.

Q: How long can I continue to make IRA contributions?

A: There is no age limit on making IRA contributions. You can continue to contribute as long as you have earned income.

Tips for Maximizing IRA Contributions

- Start Early: Begin contributing to an IRA as early as possible to take advantage of compounding returns.

- Automate Contributions: Set up automatic contributions from your paycheck or bank account to ensure regular savings.

- Consider Catch-Up Contributions: If you are over 50, take advantage of the catch-up contribution to accelerate your savings.

- Review Your Contributions Regularly: Adjust your contribution amount as needed to align with your financial circumstances and retirement goals.

- Seek Professional Advice: Consult with a financial advisor to develop a comprehensive retirement plan that includes IRA contributions.

Conclusion

The IRA contribution limit for individuals over 50 provides a valuable opportunity to boost retirement savings and potentially achieve a more comfortable retirement. By understanding the intricacies of this limit, its benefits, and potential implications, individuals can make informed decisions about their retirement planning.

It’s crucial to remember that retirement savings is a long-term endeavor, and consistent contributions, even with the catch-up contribution, can play a significant role in securing a financially secure future.

Closure

Thus, we hope this article has provided valuable insights into Navigating Retirement Savings: Understanding the IRA Contribution Limit for Individuals Over 50. We hope you find this article informative and beneficial. See you in our next article!