Forecasting the 2025 IRA Contribution Limits: Navigating the Path to Retirement Security

Forecasting the 2025 IRA Contribution Limits: Navigating the Path to Retirement Security

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Forecasting the 2025 IRA Contribution Limits: Navigating the Path to Retirement Security. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Forecasting the 2025 IRA Contribution Limits: Navigating the Path to Retirement Security

Predicting the future is an inherently complex task, especially when it comes to financial matters. However, understanding historical trends and current economic conditions can provide valuable insights into potential future scenarios. This is particularly relevant when considering Individual Retirement Accounts (IRAs), which play a crucial role in many individuals’ retirement planning.

While definitive figures for 2025 IRA contribution limits are not yet available, a comprehensive analysis of past adjustments and current economic indicators can shed light on potential scenarios. This article explores the factors influencing these limits, analyzes historical trends, and presents possible forecasts for 2025.

Understanding the Significance of IRA Contribution Limits

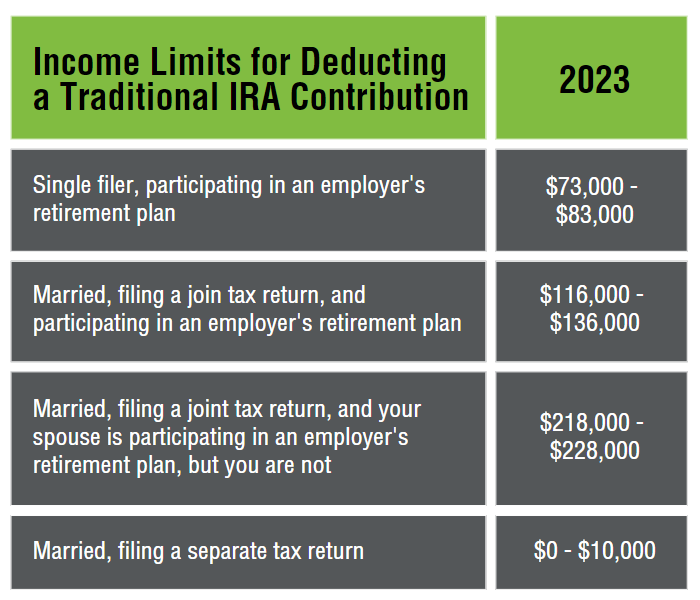

IRA contribution limits represent the maximum amount an individual can contribute to their IRA each year. These limits are adjusted annually by the Internal Revenue Service (IRS) to account for inflation and other economic factors.

The importance of these limits lies in their direct impact on retirement savings. Higher contribution limits provide individuals with greater flexibility and potential to accumulate wealth for their retirement years. Conversely, lower limits can constrain savings potential and necessitate adjustments in retirement planning strategies.

Factors Influencing IRA Contribution Limits

Several factors contribute to the annual adjustments of IRA contribution limits. These include:

- Inflation: The Consumer Price Index (CPI) is a primary indicator used to measure inflation. The IRS typically adjusts contribution limits based on the CPI, ensuring that the purchasing power of contributions remains consistent over time.

- Economic Growth: Economic growth, as measured by factors like Gross Domestic Product (GDP), can influence contribution limits. A robust economy generally supports higher limits, reflecting increased national income and a stronger financial environment.

- Government Policy: Changes in tax laws and government policies can impact IRA contribution limits. For instance, legislation aimed at promoting retirement savings may lead to increased limits.

- Social Security Benefits: The projected sustainability of Social Security benefits can also influence IRA contribution limits. As the program faces potential financial challenges, policymakers may consider adjusting contribution limits to encourage greater personal retirement savings.

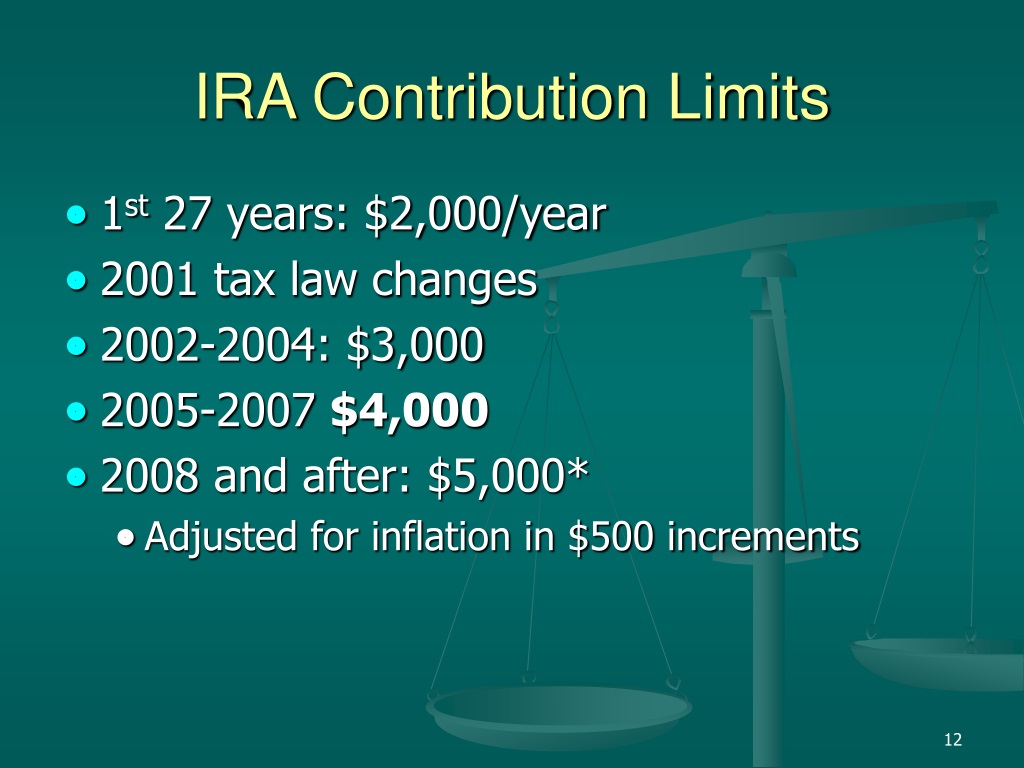

Analyzing Historical Trends

To understand potential future scenarios, it is essential to examine historical trends in IRA contribution limits. The following table presents the annual contribution limits for Traditional and Roth IRAs since 2010:

| Year | Traditional IRA | Roth IRA |

|---|---|---|

| 2010 | $5,000 | $5,000 |

| 2011 | $5,000 | $5,000 |

| 2012 | $5,000 | $5,000 |

| 2013 | $5,500 | $5,500 |

| 2014 | $5,500 | $5,500 |

| 2015 | $5,500 | $5,500 |

| 2016 | $5,500 | $5,500 |

| 2017 | $5,500 | $5,500 |

| 2018 | $5,500 | $5,500 |

| 2019 | $6,000 | $6,000 |

| 2020 | $6,000 | $6,000 |

| 2021 | $6,500 | $6,500 |

| 2022 | $6,500 | $6,500 |

| 2023 | $6,500 | $6,500 |

Analyzing this data reveals a consistent upward trend in IRA contribution limits over the past decade. This trend reflects the combined influence of inflation, economic growth, and policy decisions.

Forecasting 2025 IRA Contribution Limits

Predicting 2025 contribution limits requires considering the current economic landscape and anticipating future trends. Based on current economic conditions and historical patterns, several scenarios are possible:

- Scenario 1: Moderate Inflation and Economic Growth: If inflation remains moderate and economic growth continues at a steady pace, IRA contribution limits could see a gradual increase in line with past adjustments. This scenario suggests a potential limit of around $7,000 to $7,500 for both Traditional and Roth IRAs in 2025.

- Scenario 2: Elevated Inflation and Economic Uncertainty: If inflation persists at a higher level and economic uncertainty prevails, contribution limits may experience a more substantial increase to compensate for the erosion of purchasing power. This scenario could lead to a limit exceeding $8,000 in 2025.

- Scenario 3: Policy-Driven Adjustments: Significant changes in government policy, such as tax reforms or changes in retirement savings incentives, could significantly impact IRA contribution limits. These adjustments could either increase or decrease the limits depending on the specific policy objectives.

FAQs Regarding 2025 IRA Contribution Limits

Q: When will the 2025 IRA contribution limits be officially announced?

A: The IRS typically announces annual contribution limits for the following year in late October or early November. Therefore, the 2025 IRA contribution limits are expected to be announced in late 2024.

Q: Are the contribution limits the same for Traditional and Roth IRAs?

A: Yes, the contribution limits are generally the same for both Traditional and Roth IRAs. However, there are separate limits for individuals aged 50 and over, allowing them to contribute an additional "catch-up" amount.

Q: Can I contribute more than the annual limit to my IRA?

A: No, exceeding the annual contribution limit can result in penalties. The IRS imposes a 6% excise tax on excess contributions, which can be a significant financial burden.

Q: What happens if the contribution limits are lower than expected?

A: If the contribution limits are lower than anticipated, individuals may need to adjust their retirement savings strategies. This could involve increasing contributions to other retirement accounts, such as 401(k) plans, or exploring alternative savings options.

Tips for Maximizing IRA Contributions

- Contribute Early and Often: Starting early and contributing regularly to your IRA allows your savings to benefit from compound interest over time.

- Maximize Your Contribution Limit: Take advantage of the annual contribution limit to maximize your savings potential.

- Consider Catch-Up Contributions: Individuals aged 50 and over can contribute an additional amount to their IRA each year.

- Review Your IRA Contributions Regularly: Regularly review your contribution strategy to ensure it aligns with your retirement goals and financial circumstances.

Conclusion

Forecasting 2025 IRA contribution limits involves considering various economic and policy factors. While definitive figures are not yet available, analyzing historical trends and current economic conditions provides valuable insights into potential scenarios. Regardless of the final limits, individuals should prioritize maximizing their contributions to secure a comfortable and financially secure retirement. Understanding the factors influencing these limits and staying informed about potential adjustments is crucial for making informed decisions about retirement savings.

Closure

Thus, we hope this article has provided valuable insights into Forecasting the 2025 IRA Contribution Limits: Navigating the Path to Retirement Security. We thank you for taking the time to read this article. See you in our next article!