Navigating the 2025 IRA Catch-Up Contribution Landscape: A Comprehensive Guide

Navigating the 2025 IRA Catch-Up Contribution Landscape: A Comprehensive Guide

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the 2025 IRA Catch-Up Contribution Landscape: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the 2025 IRA Catch-Up Contribution Landscape: A Comprehensive Guide

The world of retirement savings can be complex, with numerous options and regulations to navigate. One often-overlooked tool for bolstering retirement funds is the IRA catch-up contribution. This provision allows individuals aged 50 and older to contribute additional funds to their IRA accounts, significantly accelerating retirement savings.

While the exact contribution limits fluctuate annually, understanding the mechanics of these catch-up contributions is crucial for maximizing retirement savings potential. This article provides a comprehensive overview of the 2025 IRA catch-up contribution landscape, addressing its significance, benefits, and potential implications for individuals approaching retirement.

Understanding the Basics: IRA Catch-Up Contributions

The traditional IRA and Roth IRA offer tax advantages for retirement savings. However, the annual contribution limits for these accounts are capped. For 2023, the limit for both traditional and Roth IRAs is $6,500. For individuals aged 50 and older, the catch-up contribution provision allows them to contribute an additional $1,000 per year, bringing the total contribution limit to $7,500.

The Importance of Catch-Up Contributions

The importance of catch-up contributions lies in their ability to bridge the gap between retirement savings goals and the reality of limited time. Individuals approaching retirement may find themselves with a shorter time horizon to accumulate sufficient funds for their golden years. Catch-up contributions offer a valuable opportunity to accelerate savings and mitigate the impact of delayed retirement planning.

Benefits of Catch-Up Contributions

- Accelerated Savings: Catch-up contributions allow for significantly higher annual contributions, leading to faster accumulation of retirement savings.

- Tax Advantages: The tax advantages of traditional and Roth IRAs remain applicable to catch-up contributions. Traditional IRA contributions may be tax-deductible in the current year, while Roth IRA contributions are tax-free at retirement.

- Flexibility: Catch-up contributions can be made throughout the year, providing flexibility for individuals with varying income streams or financial situations.

Catch-Up Contributions: A Case for Consideration

While the benefits are clear, it’s crucial to consider the individual circumstances before utilizing catch-up contributions. Factors such as income, existing retirement savings, and overall financial goals should be evaluated.

Potential Implications:

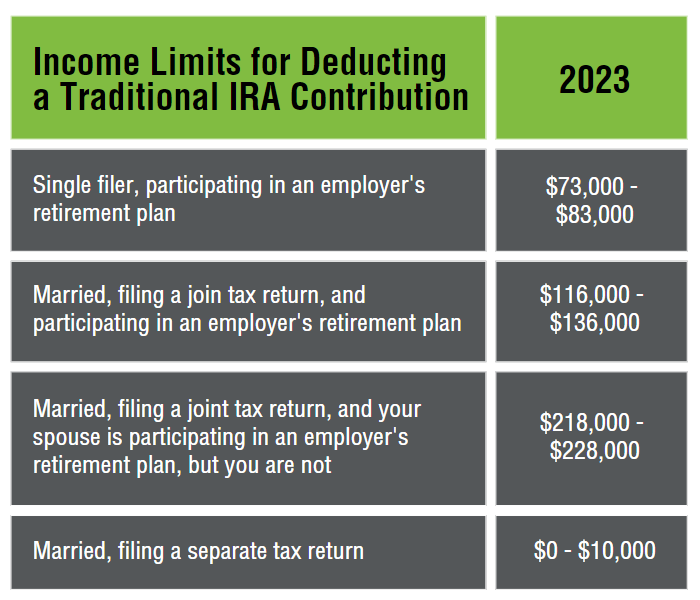

- Income Limits: Some individuals may be subject to income limitations for Roth IRA contributions, including catch-up contributions.

- Tax Implications: While catch-up contributions may offer tax advantages, it’s essential to consult with a tax professional to understand the specific implications for your individual situation.

FAQs Regarding 2025 IRA Catch-Up Contributions

1. What is the expected 2025 IRA catch-up contribution limit?

The exact limit for 2025 is not yet finalized. However, based on historical trends and inflation projections, it is likely to be higher than the 2023 limit of $1,000. The IRS typically announces these limits in the fall preceding the relevant year.

2. Can I contribute both the regular and catch-up limits?

Yes, individuals aged 50 and older can contribute the full regular limit of $6,500 (or the applicable limit for the relevant year) and the additional catch-up contribution amount.

3. Are there any income limits for catch-up contributions?

While there are no income limits for traditional IRA contributions, Roth IRA contributions, including catch-up contributions, have income limitations. Individuals exceeding these income thresholds may not be eligible for Roth IRA contributions.

4. What if I don’t need the full catch-up contribution?

Individuals are not obligated to contribute the full catch-up amount. You can contribute any amount up to the maximum allowed, based on your financial situation and retirement goals.

Tips for Maximizing Catch-Up Contributions

- Start Early: The earlier you begin utilizing catch-up contributions, the greater the impact on your overall retirement savings.

- Review Your Financial Situation: Assess your income, expenses, and existing retirement savings to determine the appropriate catch-up contribution amount.

- Seek Professional Guidance: Consult with a financial advisor or tax professional to understand the implications of catch-up contributions for your specific circumstances.

Conclusion

IRA catch-up contributions offer a valuable opportunity for individuals approaching retirement to accelerate their savings and enhance their financial security. By understanding the mechanics, benefits, and potential implications, individuals can make informed decisions about utilizing this crucial tool for a comfortable and financially secure retirement.

Remember, the 2025 IRA catch-up contribution limit is subject to change, and staying informed about these regulations is essential for maximizing retirement savings potential. Regularly review your financial plan and consult with qualified professionals to ensure your retirement savings strategy remains aligned with your evolving goals and circumstances.

.jpg_11.jpeg)

.jpg_00.jpeg)

.jpg_01.jpeg)

Closure

Thus, we hope this article has provided valuable insights into Navigating the 2025 IRA Catch-Up Contribution Landscape: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!