Navigating the 2025 IRA Contribution Landscape: A Comprehensive Guide for Individuals Under 60

Navigating the 2025 IRA Contribution Landscape: A Comprehensive Guide for Individuals Under 60

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the 2025 IRA Contribution Landscape: A Comprehensive Guide for Individuals Under 60. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the 2025 IRA Contribution Landscape: A Comprehensive Guide for Individuals Under 60

The Individual Retirement Account (IRA) stands as a cornerstone of personal retirement planning, offering individuals a tax-advantaged avenue to save for their golden years. For those under 60, understanding the contribution limits and nuances of IRAs is crucial to maximizing retirement savings potential.

Understanding IRA Contribution Limits: A Foundation for Retirement Planning

The annual contribution limit for traditional and Roth IRAs is subject to change, reflecting economic conditions and legislative adjustments. While exact figures for 2025 are not yet finalized, projections suggest potential adjustments based on recent trends.

Projected IRA Contribution Limits for 2025

It is important to note that these figures are projections and subject to change. The official limits will be announced by the IRS in the latter part of 2024.

| IRA Type | Projected 2025 Contribution Limit |

|---|---|

| Traditional IRA | $6,500 |

| Roth IRA | $6,500 |

Factors Affecting IRA Contribution Limits

The annual contribution limit is not the sole determinant of IRA contribution eligibility. Several other factors influence the maximum amount an individual can contribute, including:

- Age: Individuals over 50 are eligible for an additional "catch-up" contribution, allowing them to contribute a higher amount. For 2025, the projected catch-up contribution limit is $1,000, bringing the total allowable contribution to $7,500.

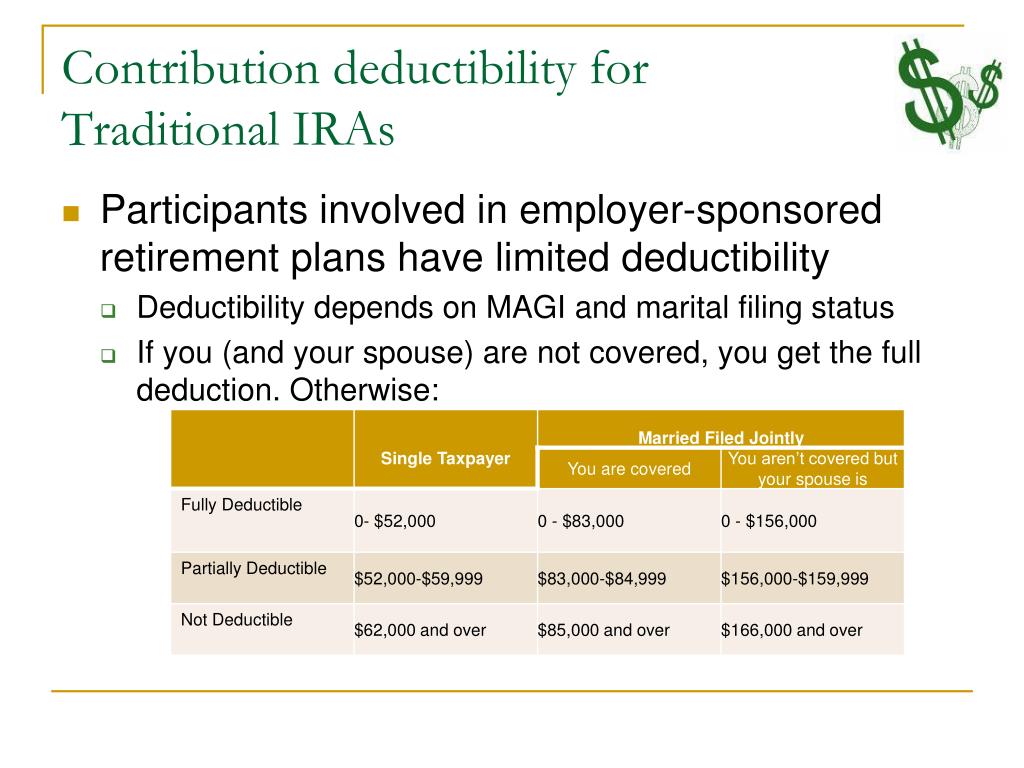

- Modified Adjusted Gross Income (MAGI): Roth IRA eligibility is subject to income limitations. For 2025, individuals with MAGIs exceeding certain thresholds may be unable to contribute to a Roth IRA or may face a reduced contribution limit.

- Prior Year Contributions: If an individual already contributed to a traditional or Roth IRA in a previous year, the contribution limit may be affected.

The Importance of Understanding Contribution Limits

Understanding the IRA contribution limits is essential for maximizing retirement savings. Contributing the maximum allowable amount each year helps individuals accumulate a larger retirement nest egg, potentially leading to a more comfortable and secure retirement.

Key Benefits of Utilizing IRA Contribution Limits

- Tax Advantages: Traditional IRAs offer tax-deductible contributions, reducing current tax liability. Roth IRAs, conversely, provide tax-free distributions in retirement.

- Growth Potential: IRA contributions have the potential to grow tax-deferred or tax-free, allowing for substantial accumulation over time.

- Flexibility: IRAs offer flexibility in investment choices, allowing individuals to tailor their portfolio to their risk tolerance and financial goals.

Frequently Asked Questions (FAQs) Regarding IRA Contribution Limits

Q: Can I contribute to both a traditional and Roth IRA in the same year?

A: Yes, individuals may contribute to both a traditional and Roth IRA in the same year, provided they do not exceed the annual contribution limit for each account type.

Q: What happens if I contribute more than the annual limit?

A: Contributing more than the annual limit can result in penalties. The IRS may impose a 6% penalty on excess contributions.

Q: Can I withdraw my IRA contributions before retirement?

A: While early withdrawals from traditional IRAs are generally subject to a 10% penalty, certain exceptions exist. Roth IRA contributions can be withdrawn at any time without penalty.

Q: When should I start contributing to an IRA?

A: The earlier you start contributing to an IRA, the greater the potential for long-term growth. Even small contributions can add up significantly over time.

Tips for Maximizing IRA Contributions

- Contribute early and often: The earlier you start contributing, the more time your investments have to grow.

- Take advantage of catch-up contributions: If you are over 50, consider contributing the additional catch-up amount.

- Diversify your investments: Spread your IRA contributions across different asset classes to manage risk.

- Review your portfolio regularly: Adjust your investment strategy as needed to align with your financial goals and market conditions.

Conclusion

Understanding and maximizing IRA contribution limits is a critical step in building a secure retirement future. By contributing the maximum allowable amount each year, individuals can leverage the power of tax advantages and long-term growth potential to accumulate a substantial retirement nest egg. Regularly reviewing and adjusting contribution strategies based on individual circumstances and market conditions ensures optimal retirement planning outcomes. Remember to consult with a financial advisor to personalize your IRA contribution strategy and navigate the ever-evolving landscape of retirement savings.

Closure

Thus, we hope this article has provided valuable insights into Navigating the 2025 IRA Contribution Landscape: A Comprehensive Guide for Individuals Under 60. We appreciate your attention to our article. See you in our next article!