Navigating the 2025 IRA Contribution Landscape: A Comprehensive Guide

Navigating the 2025 IRA Contribution Landscape: A Comprehensive Guide

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the 2025 IRA Contribution Landscape: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the 2025 IRA Contribution Landscape: A Comprehensive Guide

The Individual Retirement Account (IRA) stands as a cornerstone of retirement planning in the United States. These accounts offer individuals a powerful tool to accumulate wealth over time, enjoying tax advantages and potentially reducing their tax burden in retirement. Understanding the contribution limits for IRAs is crucial for maximizing their potential. While these limits are subject to annual adjustments based on inflation, this article provides a comprehensive overview of the projected contribution limits for 2025, shedding light on their significance and offering insights into optimizing retirement savings.

Understanding IRA Contribution Limits: A Foundation for Retirement Planning

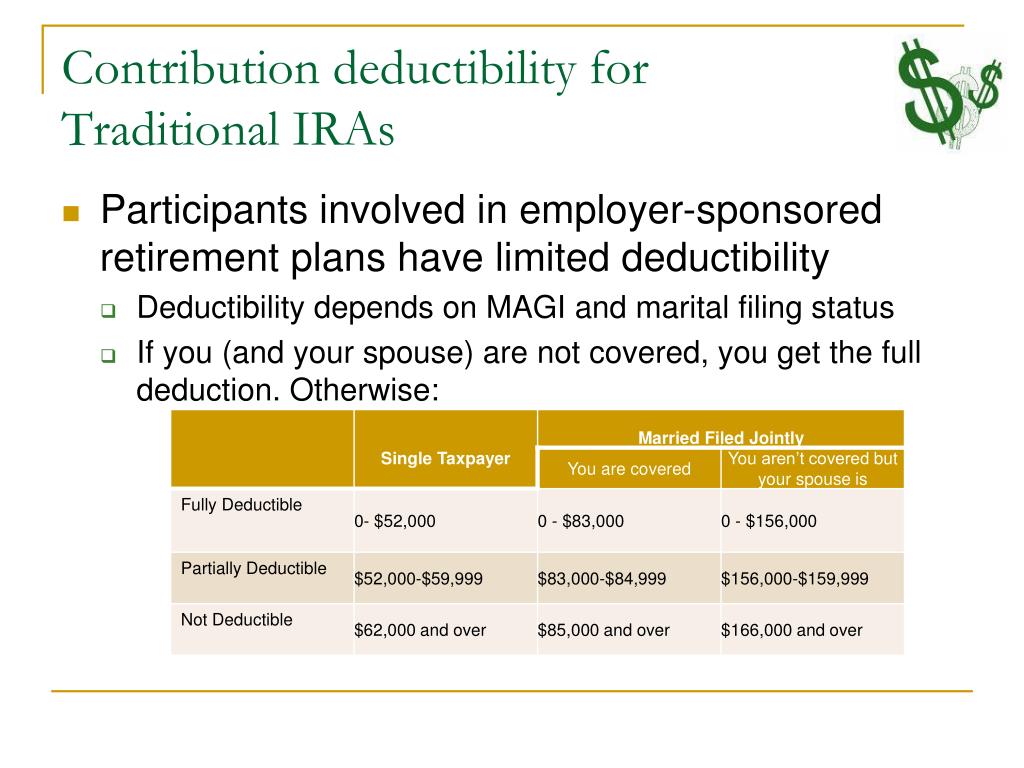

The Internal Revenue Service (IRS) establishes annual contribution limits for both traditional and Roth IRAs. These limits represent the maximum amount individuals can contribute to their IRA each year without incurring penalties. The contribution limits are designed to promote responsible retirement planning, ensuring individuals contribute a reasonable amount while leaving room for other financial needs.

Projected IRA Contribution Limits for 2025

While the IRS typically announces the annual contribution limits in the fall of the preceding year, it is possible to project the 2025 limits based on historical trends and current economic conditions. Based on projections, the contribution limit for both traditional and Roth IRAs in 2025 is anticipated to be $7,000. This represents an increase from the 2024 limit, reflecting the impact of inflation.

The Significance of IRA Contribution Limits

The IRA contribution limits serve several important functions:

- Encouraging Regular Savings: The limits provide a clear target for individuals, promoting consistency in retirement savings.

- Promoting Financial Discipline: By setting a maximum contribution amount, individuals are encouraged to prioritize their retirement planning and avoid over-contributing, potentially jeopardizing other financial goals.

- Ensuring Tax Advantages: The limits ensure that individuals maximize their tax benefits while remaining within the guidelines set by the IRS.

- Facilitating Retirement Security: By encouraging regular contributions, the limits contribute to the long-term financial security of individuals, providing a strong foundation for retirement.

Factors Influencing IRA Contribution Limits

The IRS considers several factors when determining annual contribution limits:

- Inflation: The limits are typically adjusted annually to reflect the rate of inflation, ensuring that the purchasing power of contributions remains relatively consistent.

- Economic Conditions: Economic factors, such as growth and employment levels, may also influence the annual adjustments.

- Government Policy: The IRS may adjust the limits based on changes in government policy related to retirement savings.

Maximizing IRA Contributions: Strategies and Considerations

Individuals can maximize their IRA contributions through various strategies:

- Regular Contributions: Consistent contributions throughout the year are crucial for maximizing the benefits of compounding.

- Catch-Up Contributions: Individuals aged 50 and older can make additional catch-up contributions, allowing them to contribute more each year and accelerate their retirement savings.

- Contribution Timing: While contributions can be made at any time during the year, individuals may benefit from making contributions early in the year to maximize the potential for growth.

- Contribution Strategy: Individuals should consider their overall financial situation and retirement goals when determining their contribution strategy.

FAQs Regarding IRA Contribution Limits

Q: What happens if I contribute more than the IRA contribution limit?

A: If an individual exceeds the IRA contribution limit, the excess contribution will be subject to a 6% penalty. Additionally, the excess contribution may be considered taxable income in the year it was made.

Q: Can I contribute to both a traditional and a Roth IRA?

A: Individuals can contribute to both a traditional and a Roth IRA, but the combined contribution amount cannot exceed the annual limit.

Q: Are there income limits for contributing to a Roth IRA?

A: Yes, there are income limits for contributing to a Roth IRA. If an individual’s modified adjusted gross income exceeds a certain threshold, they may not be able to contribute to a Roth IRA or their contributions may be limited.

Q: Can I withdraw contributions from my IRA before retirement?

A: Yes, individuals can withdraw contributions from their IRA before retirement without penalty. However, any earnings on the contributions will be subject to taxes and potentially penalties.

Q: How do I know if I am eligible to contribute to an IRA?

A: Individuals who have earned income are typically eligible to contribute to an IRA. However, there are specific rules and requirements that may apply depending on the type of IRA and the individual’s circumstances.

Tips for Optimizing IRA Contributions

- Start Early: The earlier individuals begin contributing to their IRA, the greater the potential for growth due to compounding.

- Maximize Contributions: Contribute the maximum amount allowed each year to maximize the benefits of tax-advantaged savings.

- Diversify Investments: Spread investments across various asset classes to mitigate risk and potentially enhance returns.

- Review Contributions Regularly: Periodically review contribution amounts and investment strategies to ensure they align with current financial goals and circumstances.

- Seek Professional Advice: Consult with a financial advisor to develop a personalized retirement plan and ensure contributions are optimized for individual needs.

Conclusion: Embracing the Power of IRA Contributions

The annual IRA contribution limits serve as a vital guide for individuals seeking to secure their financial future. By understanding these limits, individuals can maximize their tax advantages, promote responsible retirement planning, and build a solid foundation for their financial well-being. Regular contributions, strategic investment choices, and a commitment to long-term savings are essential components of a successful retirement journey. By embracing the power of IRA contributions, individuals can navigate the complexities of retirement planning with confidence and achieve their financial aspirations.

Closure

Thus, we hope this article has provided valuable insights into Navigating the 2025 IRA Contribution Landscape: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!