Navigating the 2025 IRA Contribution Landscape: A Guide to Traditional and Roth Options

Navigating the 2025 IRA Contribution Landscape: A Guide to Traditional and Roth Options

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the 2025 IRA Contribution Landscape: A Guide to Traditional and Roth Options. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the 2025 IRA Contribution Landscape: A Guide to Traditional and Roth Options

The Individual Retirement Account (IRA) remains a cornerstone of retirement planning, offering individuals a tax-advantaged vehicle to save for their golden years. Understanding the contribution limits and nuances of both Traditional and Roth IRAs is crucial for maximizing their potential. This article delves into the 2025 contribution limits for both IRA types, outlining their key differences and providing insights into their potential benefits.

Traditional IRA: Tax Deductible Contributions, Taxable Distributions

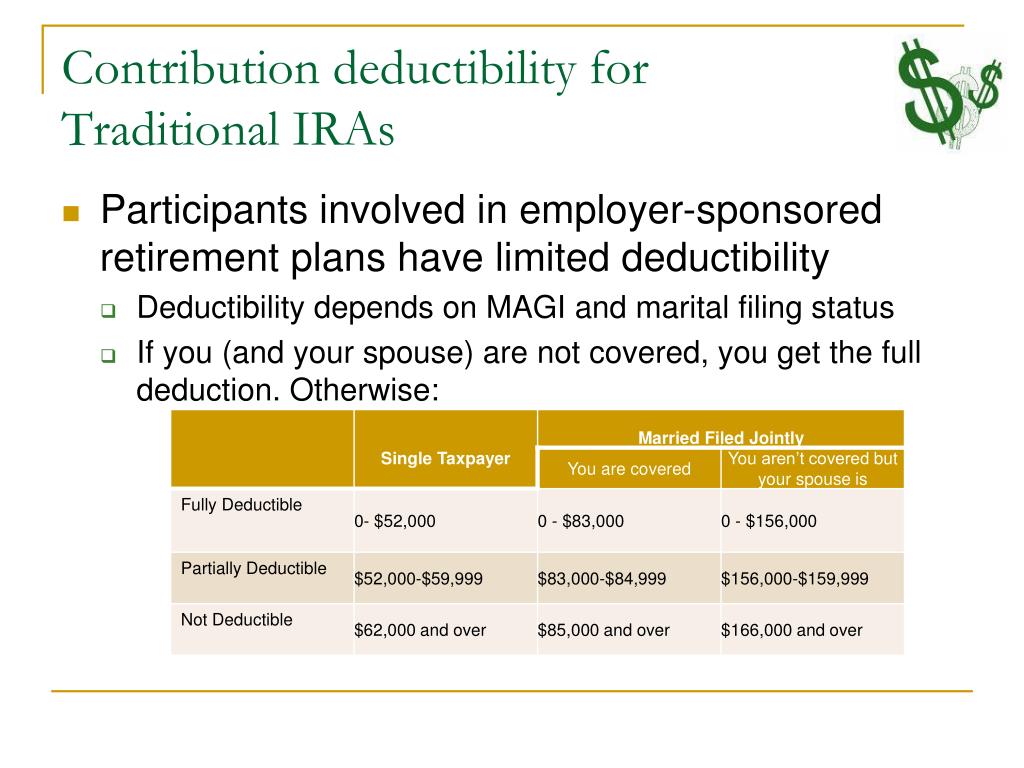

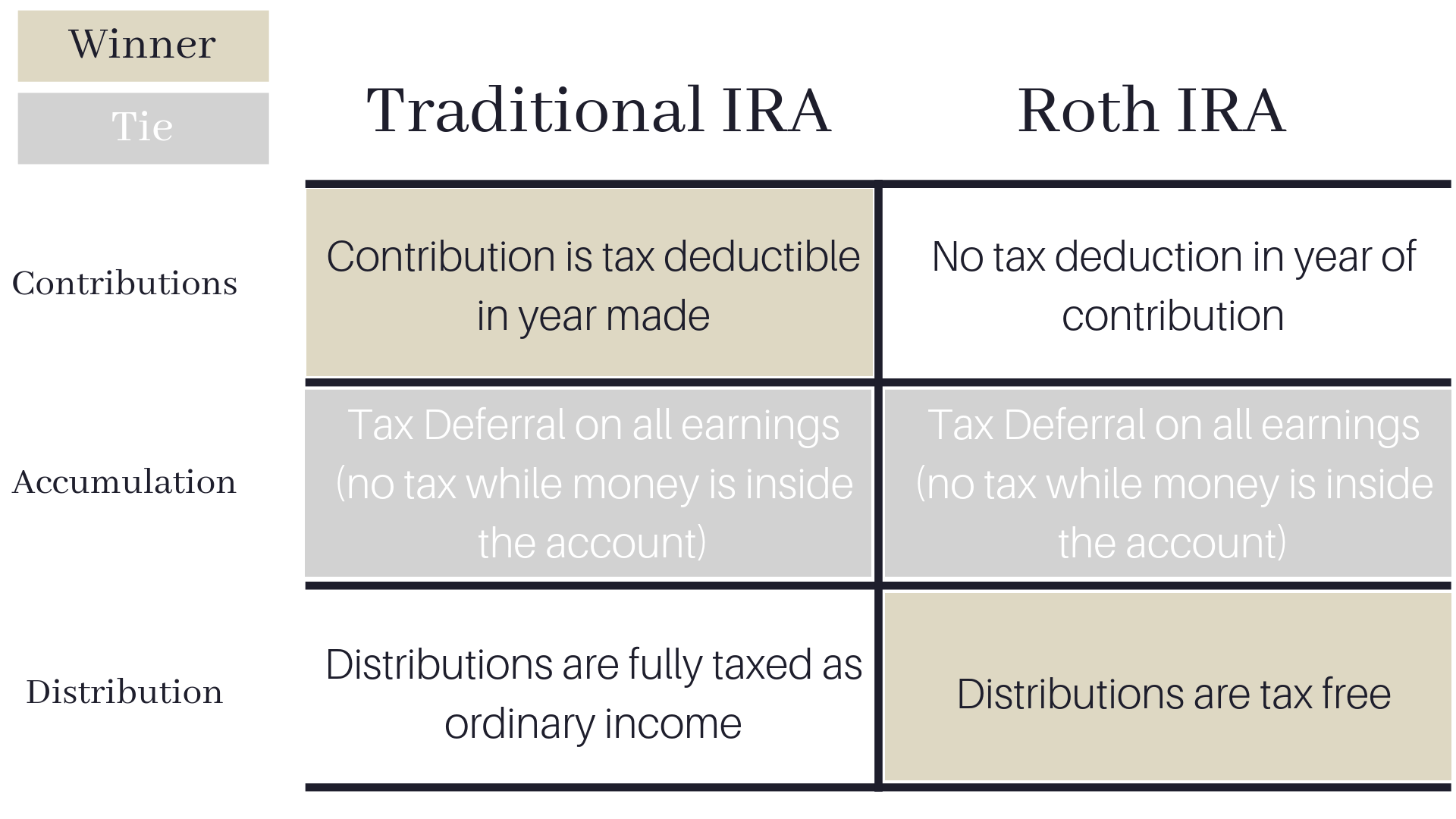

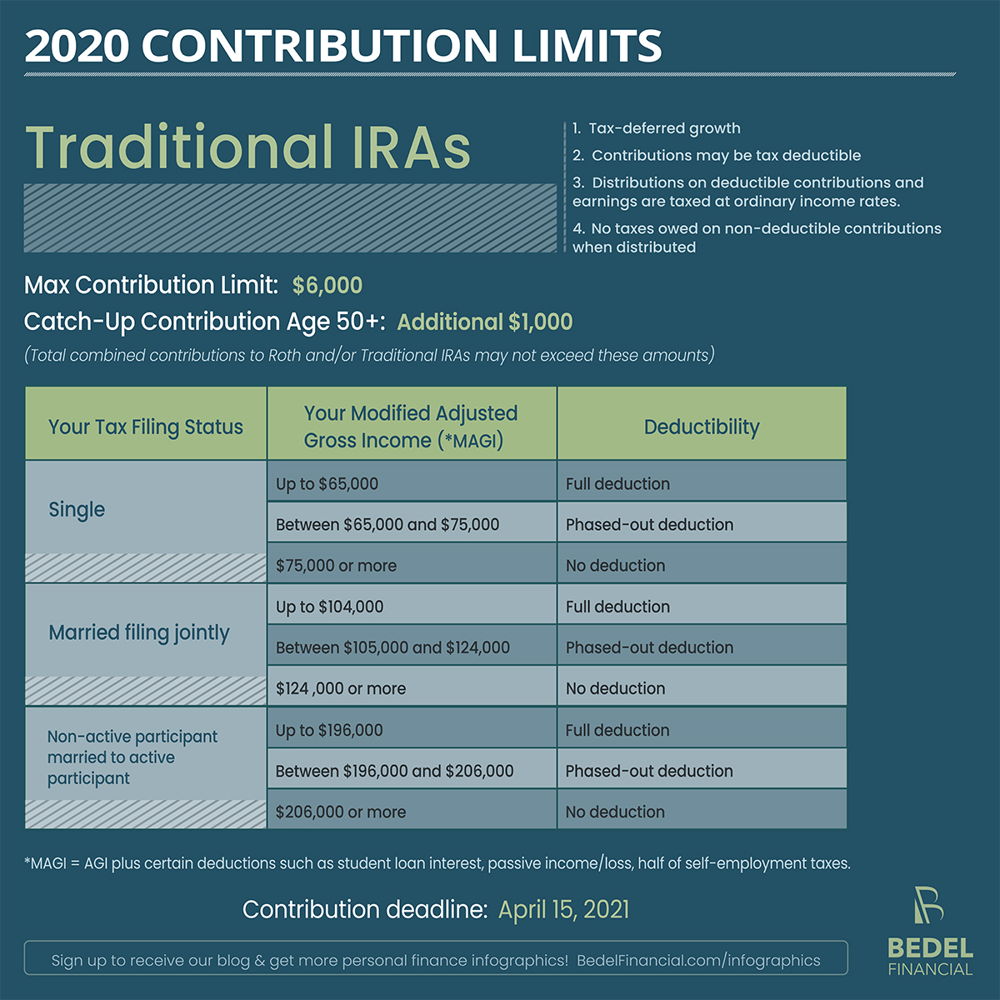

A Traditional IRA allows individuals to contribute pre-tax dollars, reducing their current tax liability. However, withdrawals in retirement are subject to taxation. This structure is particularly advantageous for those who expect to be in a lower tax bracket in retirement than they are currently.

Contribution Limits for 2025:

- Individuals under 50: $6,500

- Individuals 50 and over: $7,500

Roth IRA: Taxable Contributions, Tax-Free Distributions

Conversely, a Roth IRA requires individuals to contribute after-tax dollars, but withdrawals in retirement are tax-free. This option is often favored by those who anticipate being in a higher tax bracket during retirement.

Contribution Limits for 2025:

- Individuals under 50: $6,500

- Individuals 50 and over: $7,500

Key Considerations:

- Income Limits: While there are no income restrictions for contributing to a Traditional IRA, the Roth IRA has income limitations for those who wish to contribute the full amount. For 2025, individuals with modified adjusted gross income (MAGI) exceeding $153,000 (single filers) or $228,000 (married filing jointly) cannot contribute to a Roth IRA. Those exceeding the income limits may still be eligible to contribute to a Traditional IRA.

- Tax Bracket: The decision between a Traditional and Roth IRA hinges on individual circumstances and projected tax brackets. Those who anticipate being in a higher tax bracket in retirement may benefit from a Roth IRA, while those expecting a lower tax bracket may find a Traditional IRA more advantageous.

- Retirement Planning: Both IRA types offer significant tax benefits, but their suitability depends on individual financial goals and risk tolerance. Consulting with a financial advisor can help determine the optimal strategy for retirement planning.

Frequently Asked Questions:

Q: Can I contribute to both a Traditional and Roth IRA in the same year?

A: Yes, you can contribute to both a Traditional and Roth IRA in the same year, provided you meet the respective income limitations. However, the total contribution across both accounts cannot exceed the annual contribution limit. For 2025, this limit is $6,500 for individuals under 50 and $7,500 for individuals 50 and over.

Q: What happens if I exceed the contribution limit?

A: If you exceed the contribution limit, you will be subject to a 6% penalty on the excess contribution. This penalty is calculated annually and applies to the excess amount, not the entire contribution.

Q: Can I withdraw contributions from my IRA before retirement?

A: Yes, you can withdraw contributions from your IRA before retirement without penalty. However, withdrawals of earnings are subject to taxes and penalties if taken before age 59 1/2.

Q: Can I roll over funds from a 401(k) to an IRA?

A: Yes, you can roll over funds from a 401(k) to an IRA, either Traditional or Roth. The rollover process involves transferring funds from your 401(k) to the chosen IRA account. It is important to consult with a financial advisor to ensure the rollover is executed properly and tax implications are understood.

Tips for Maximizing IRA Contributions:

- Contribute early and consistently: The earlier you begin contributing to an IRA, the more time your investments have to grow. Even small, regular contributions can significantly impact your retirement savings.

- Take advantage of the catch-up contribution: Individuals aged 50 and over can contribute an additional $1,000 to their IRA each year.

- Diversify your portfolio: Invest in a mix of assets, such as stocks, bonds, and real estate, to mitigate risk and maximize potential returns.

- Review your investment strategy regularly: Regularly review your investment allocation and adjust it as needed to align with your financial goals and risk tolerance.

- Consider working with a financial advisor: A financial advisor can provide personalized guidance and help you create a comprehensive retirement plan.

Conclusion:

The 2025 IRA contribution limits offer a valuable opportunity for individuals to save for retirement while benefiting from tax advantages. Understanding the nuances of both Traditional and Roth IRAs, coupled with strategic planning, can significantly enhance your retirement security. Consulting with a financial advisor can provide personalized insights and help you navigate the complexities of retirement planning. By maximizing your IRA contributions and carefully managing your investments, you can set yourself on a path towards a comfortable and fulfilling retirement.

Closure

Thus, we hope this article has provided valuable insights into Navigating the 2025 IRA Contribution Landscape: A Guide to Traditional and Roth Options. We hope you find this article informative and beneficial. See you in our next article!