Understanding IRA Contribution Limits for 2025: A Comprehensive Guide

Understanding IRA Contribution Limits for 2025: A Comprehensive Guide

Introduction

With great pleasure, we will explore the intriguing topic related to Understanding IRA Contribution Limits for 2025: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Understanding IRA Contribution Limits for 2025: A Comprehensive Guide

The Individual Retirement Account (IRA) is a valuable tool for individuals seeking to save for retirement. It allows for tax-advantaged growth of investments, potentially leading to a more comfortable financial future. Understanding the contribution limits for IRAs is crucial for maximizing the benefits of this savings vehicle. This article will delve into the 2025 IRA contribution limits, exploring their significance and providing insights for maximizing retirement savings.

2025 IRA Contribution Limits: A Breakdown

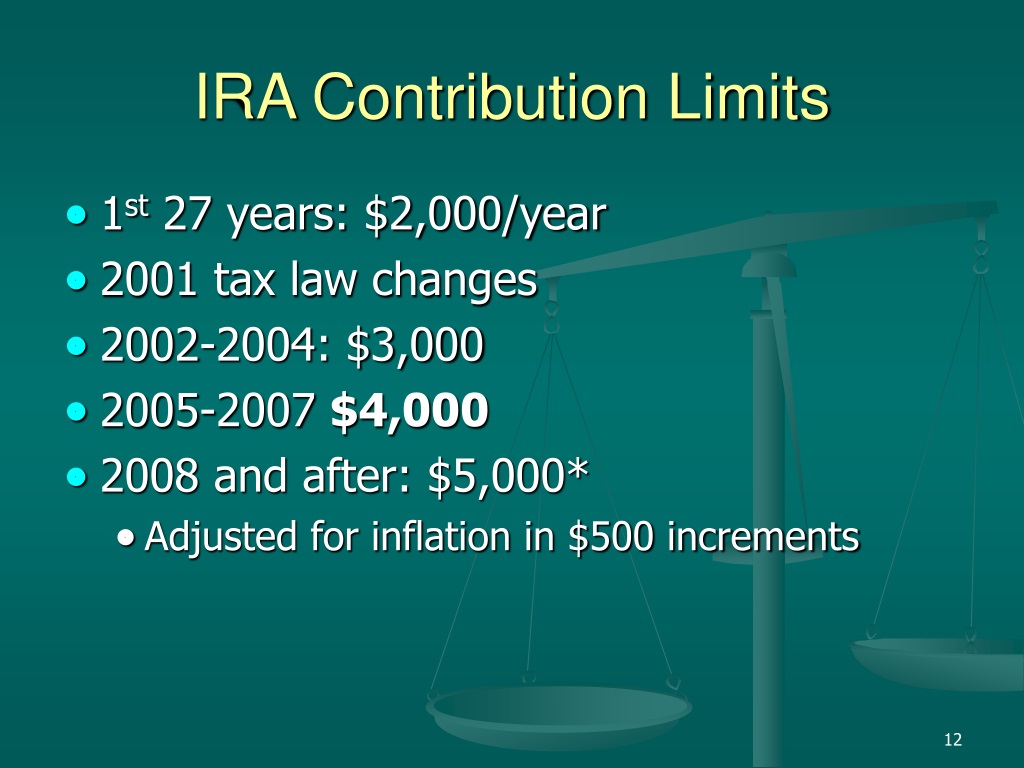

For 2025, the maximum contribution allowed for traditional and Roth IRAs is $7,500. This figure represents a significant increase from the 2024 limit of $7,000, reflecting the ongoing efforts to adjust contribution limits for inflation.

Contribution Limits for Individuals Aged 50 and Over

Individuals aged 50 and older are eligible for an additional "catch-up" contribution, allowing them to contribute an extra $1,500 in 2025. This brings the total maximum contribution for those 50 and older to $9,000. This additional contribution provides a valuable opportunity for older individuals to accelerate their retirement savings.

The Importance of Understanding IRA Contribution Limits

Comprehending IRA contribution limits is crucial for several reasons:

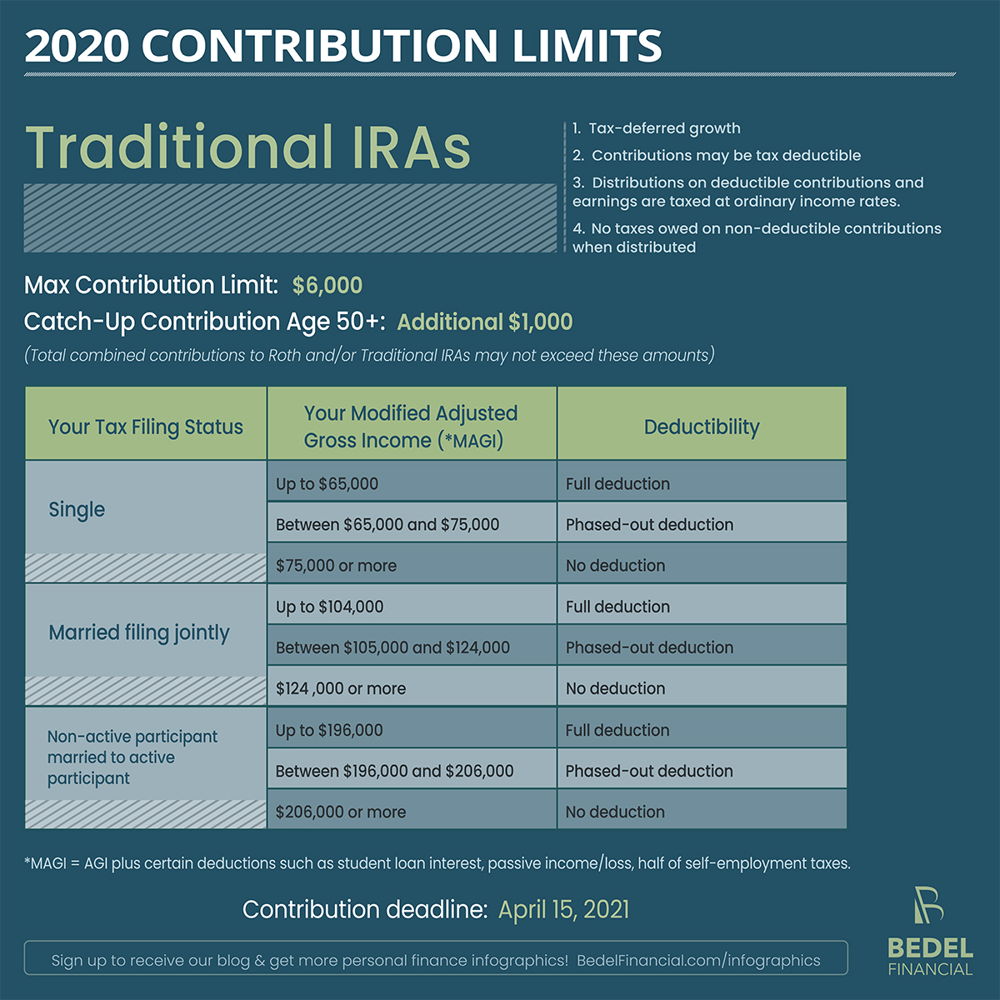

- Maximizing Tax Advantages: By fully utilizing the allowed contribution, individuals can take full advantage of the tax benefits offered by IRAs. Traditional IRAs allow for tax-deductible contributions, reducing current tax liabilities, while Roth IRAs offer tax-free withdrawals in retirement.

- Accelerating Retirement Savings: Higher contribution limits enable individuals to accumulate a larger retirement nest egg. This can lead to greater financial security and peace of mind during retirement.

- Avoiding Penalties: Exceeding the contribution limits can result in penalties. It is essential to stay informed about the current limits to avoid these financial repercussions.

Factors Influencing IRA Contribution Limits

Several factors can influence IRA contribution limits, including:

- Age: As mentioned earlier, individuals aged 50 and older are eligible for catch-up contributions.

- Income: For Roth IRAs, income limitations apply. Individuals exceeding specific income thresholds may not be able to fully contribute or contribute at all.

- Tax Law Changes: Contribution limits are subject to change based on legislative updates and economic conditions. It is crucial to stay informed about any adjustments to contribution limits.

FAQs on 2025 IRA Contribution Limits

1. What is the difference between a traditional IRA and a Roth IRA?

A traditional IRA allows for tax-deductible contributions, reducing current tax liabilities. However, withdrawals in retirement are taxed as ordinary income. A Roth IRA, on the other hand, requires contributions to be made with after-tax dollars, but withdrawals in retirement are tax-free.

2. Can I contribute to both a traditional and Roth IRA in the same year?

Yes, you can contribute to both a traditional and Roth IRA in the same year, but your total contributions cannot exceed the annual limit.

3. What happens if I exceed the contribution limit?

Exceeding the IRA contribution limit can result in a 6% penalty on the excess amount.

4. Can I make a lump-sum contribution or do I have to contribute throughout the year?

You can make a lump-sum contribution to your IRA or contribute throughout the year. However, the total contribution for the year cannot exceed the annual limit.

5. How do I know if I qualify for a Roth IRA?

Income limitations apply to Roth IRAs. The IRS provides specific income thresholds based on filing status. If your income exceeds these thresholds, you may not be able to fully contribute or contribute at all to a Roth IRA.

Tips for Maximizing IRA Contributions

- Contribute Early and Regularly: Start contributing early and consistently to maximize the benefits of compounding growth.

- Take Advantage of Catch-Up Contributions: If you are 50 or older, utilize the catch-up contribution to accelerate your retirement savings.

- Consider a Roth IRA if You Expect to Be in a Higher Tax Bracket in Retirement: Roth IRAs offer tax-free withdrawals in retirement, which can be advantageous for those anticipating higher tax rates in the future.

- Seek Professional Financial Advice: Consult with a financial advisor to determine the most suitable IRA strategy for your individual circumstances.

Conclusion

Understanding and maximizing IRA contribution limits is essential for achieving financial security in retirement. By fully utilizing the available contribution limits, individuals can take advantage of tax benefits, accelerate their savings, and potentially achieve a more comfortable financial future. It is crucial to stay informed about current contribution limits, seek professional advice when necessary, and make informed decisions regarding IRA contributions.

Closure

Thus, we hope this article has provided valuable insights into Understanding IRA Contribution Limits for 2025: A Comprehensive Guide. We appreciate your attention to our article. See you in our next article!